What are the New Lease Accounting Changes under ASC 842?

Lucas Russell | 2021-05-24

The changes to the new lease accounting standard ASC 842 are incredibly specific towards one role in the lease transaction, the lessee (the party in the transaction that is leasing the asset) and those leases classified as operating leases.

For those that are lessors, it's business as usual, and the same goes for lessees with only capital leases. Not too much has changed other than capital leases are now called finance leases. If you're in either of those two parties, the accounting you apply under the new lease accounting standard has not fundamentally changed.

Operating leases under ASC 840

The good ol days, under ASC 840 accounting for a lease deemed an operating lease, couldn't be easier. A company would pay the invoice when it was due and wouldn't think twice. The accounting applied was no different from paying an electricity bill or any ad hoc expense.

Now technically speaking, ASC ASC 840-20-25-1 is a little more prescriptive than above:

Rent shall be charged to expense by lessees (reported as income by lessors) over the lease term as it becomes payable. If rental payments are not made on a straight-line basis, rental expense nevertheless shall be recognized on a straight-line basis unless another systematical and rational basis is more representative of the time pattern in which use benefit is derived from the leased property, in which case that basis shall be used.

But you get the gist, under ASC 840, the most complex aspect of accounting for an operating lease is booking the expense to the income statement!

In other words, to comply with an operating lease under ASC 840 was incredibly simple. Under the previous standard, the cumbersome classification was a capital lease. Accounting for an operating lease was far more favorable from various perspectives. Many companies would try any trick in the book (that their auditors were comfortable with) to get the lease classification as operating lease instead of a capital lease.

Operating leases under ASC 842

To say the change in accounting for an operating lease under ASC 842 is material would be an understatement.

So what is this change? Under ASC 842, leases classified as operating leases are now recorded on a company's balance sheet. An operating lease can no longer be expensed as each invoice is received from the lessor [1]. The lessee must recognize a lease liability which is the present value of the future lease payments, and a right of use asset, which like the name suggests, represents the lessee's right to use the leased asset. The value of the lease liability and right of use asset declines through the lease term, and at the end of the lease, both balances will be amortized to zero.

[1] The only exception to this rule is if the lease term is shorter than 12 months.

What is a lease liability and right of use asset?

The easiest way to comprehend this change is it's the same concept as accounting for a capital lease under ASC 840. To calculate the lease liability, the lessee requires three inputs:

- Lease payment amounts

- Timing of the lease payments

- Discount rate

The discount rate is used to present value the lease payments. Once present valued, you have a lease liability. There's a lot more to this, so if you would like further information, I'd recommend reading:

- How to Calculate the Present Value of Future Lease Payments

- Our guide on how to calculate the initial value of the lease liability

- Our step by step article on how to calculate the unwinding of the lease liability

The next item to familiarize with is the right of use asset. That value is derived from the lease liability plus or minus a few other inputs. The right of use asset for an operating lease amortizes to zero upon the expiry of the lease. To calculate the right of use asset, I'd recommend reading the following material:

- Our guide on how to calculate the initial value of the right of use asset

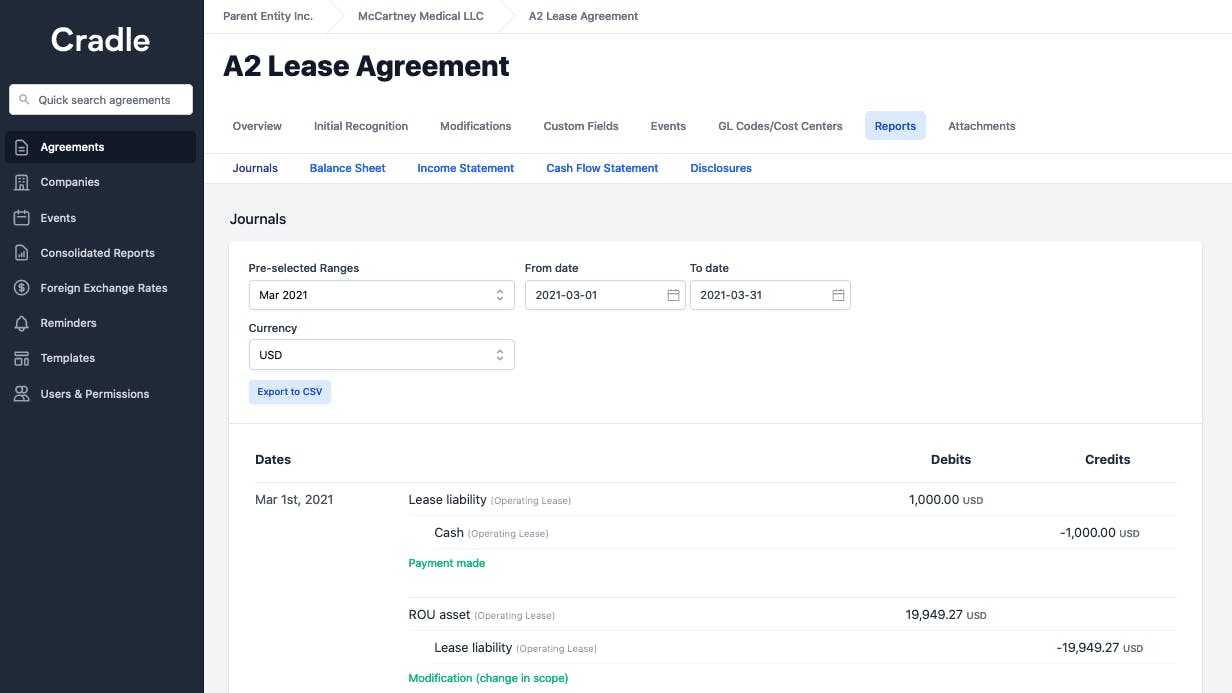

Modification accounting

Another tricky aspect of accounting for an operating lease under the new lease accounting standard is when a lease agreement is modified. Previously, because the lease payments were expensed, it was just a matter of pay less or more. Because the lessee is required to present value the future lease payments, if those change, so does the value of the lease liability and the right of asset. To account for this change, the lessee must first update present value calculations, recorded the movement, and post the required journals to reflect the new balances. To learn more about modification accounting, I'd recommend referring to our guide.

Here are some articles that will assist when manually accounting for a lease modification:

How to transition to ASC 842

Noting all these changes, how does a company transition from ASC 840 to ASC 842? Again there's no shortcut for identifying all the possible leases in the scope of ASC 842; many leases may have been missed due to the immaterial impact of accounting for them under ASC 840. For further details on transition, refer here:

Other complexities

Other complexities can also arise when accounting for an operating lease. Foreign exchange (FX) accounting can be extremely time-consuming. FX accounting can occur if a lessee domiciled in the US, with a US dollar reporting currency entering into a lease in a foreign currency, for example, Canadian dollars. Or a subsidiary's functional currency is different from the parents reporting currency.

Another complexity that can arise is sub-lease accounting. It is not uncommon for a lessee to enter into a sub-lease. If that occurs, the lessee will need to apply the principles of lessor accounting while at the same time maintaining the requirements as a lessee.

Lease accounting software

If you have now familiarized yourself with those required accounting changes required for operating leases under ASC 842, you will see the manual requirements of the standards are significant. Firstly starting with the net present value calculations, then reflecting the calculations with journal entries every month. Not to mention the required year-end disclosure requirements. This is where lease accounting software can essentially automate your compliance and give you complete visibility of your lease portfolio, something you may not have had under the previous lease accounting standard.

If you're curious to understand what features you should look out for when procuring lease accounting software, refer to the article Lease Accounting Software Guide for 2021.

Lease accounting software should automated every step of your compliance, starting with the NPV calculations, journal entries, financial reports, and even year-end disclosures. Not to mention, be intuitive to use. If you would like to see what month-end would look like using our lease accounting software, refer here. Our pricing is transparent, and we offer a free 30-day trial; you can take advantage of no strings attached.

The easiest way to transition

Why not use Cradle to streamline and automate the manual requirements of ASC 842? Schedule a 30-minute demo to see how easy lease accounting can be.