GASB 87 Guide

Where to start

GASB 87 is the new leasing standard, superseding a number of previous lease accounting standards being:

- GASB Statement No. 62: Issued in 2010, GASB 62 mirrors most of ASC 840 and harmonized the accounting between the lease accounting standards.

- GASB Statement No. 13: Issued in 1990 and outlined how to accounting for operating leases.

- NCGA Statement No. 5: Issued in 1986

The earliest period the standard is effective has changed, the announcement by GASB on May 8th 2020 the effective date has been postponed by 18 months from December 15, 2019. This will take the standard being effective for reporting periods beginning after June 15 2021.

What has changed

We still have the lessee & lessor classification. For lessors and lessees with capital leases, most remain the same. However, the main change comes if you have an operating lease under the previous standard. In this case, you’re in for some major changes when accounting under GASB 87.

The standard moves to a single-model approach. Once a lease is deemed in the scope of GASB 87 and no practical expedients are utilized the contract will be accounted as a finance lease (new terminology for a capital lease). This approach is very similar to the rest of the world accounting under IFRS 16, whilst under ASC 842 the classification between operating and finance leases is carried forward.

Which means the contracts come on the balance sheet. Under GASB 87, the first thing you’ll do is recognize:

- Lease Asset - this represents the value of the item being leased

- Lease Liability - the present value of the minimum future lease payments

Change of focus

Under GASB 87 your auditors will no longer be concerned with whether it’s an operating or capital lease, but put the main focus on the step prior to that, to determine if it is this a contract lease and if it is in the scope of GASB 87. From a preparers’ perspective it’s paramount you have a process in place to ensure completeness of contracts to capture all applicable contracts within the scope of the new leasing standard.

Is it a lease?

Paragraph four defines a lease as “For purposes of applying this Statement, a lease is defined as a contract that conveys control of the right to use another entity’s non-financial asset as specified in the contract for a period of time in an exchange or exchange-like transaction.

To help determine control of the underlying asset paragraph 5 provides further guidance a government should assess whether it has both of the following as per GASB 87.5:

a. The right to obtain the present service capacity from the use of the underlying asset as specified in the contract.

b. The right to determine the nature and manner of use of the underlying asset as specified in the contract.

Timeframe

It should also be noted the timeframe must be explicitly stated. The timeframe can be interrupted e.g lease a warehouse for each Monday. Under GASB 87 that would still qualify as a period of time.

Types of assets

Most common assets that will fit this definition will be:

- Land

- Buildings

- Vehicles

- Equipment

Exchange or exchange like

The lessor must require the lessee to provide relative consideration in return. For example, the lessor allows the lessee to lease downtown office space for $1 a month. This would not meet the definition of relative consideration. Other examples that would not meet the definition is:

- Donations

- Grants

Scoped out agreements

Both lessee and lessors can omit the following types of agreements when applying the accounting guidance of GASB 87.8:

- Leases of Intangible Assets, Biological Assets, and Inventory

- Service Concession Arrangements

- Supply Contracts

- Title transfer to the lessee:

- Short-term Leases: GASB 87.17 A short-term lease is a lease that, at the commencement of the lease term, the maximum possible term under the lease contract of 12 months

undefinedundefined

Lease Components

A Lessees may enter into contracts that contain multiple components, such as a contract that contains both a lease component and a non-lease component. An example of this is leasing office space that also includes a daily cleaning service.

The government entity should account for the lease and non-lease components as separate contracts unless the contract meets the exception in paragraph 67.

Paragraph 67 states only if it is not practicable to determine the best estimate for price allocation for some or all components in the contract, a government should account for those components as a single lease unit.

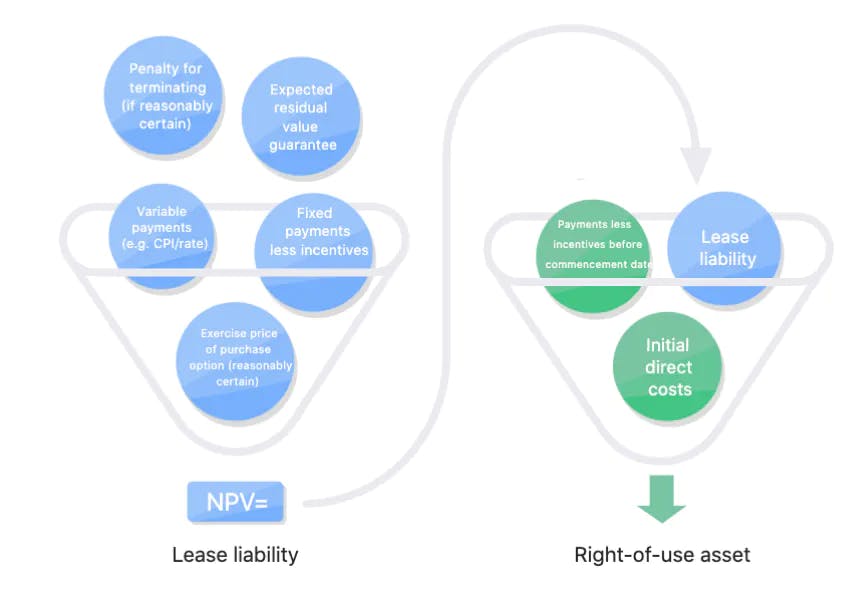

Initial recognition

Once the contract is deemed to be in the scope of GASB 87, there are a number of considerations to make, which will have a direct impact on your debits and credits. Firstly, we’ll focus on the lease liability.

The lease liability consists of three inputs:

- Lease payments: these are the contractually agreed upon future payments the lessee will pay to the lessor

- Lease term: the most reasonably likely period of time the lessee expects to use the Lease Asset.

- Discount rate: the rate used to present value the future lease payments

Lease payments

One of the key inputs to the lease liability is the present value of the future lease payments known at initial recognition. As per GASB 87.21 they consist of:

- Fixed payments less incentives

- Variable payments that are fixed in substance this includes index (CPI), market rent review (MRR) or rate (Libor)

- Residual value guarantee

- The exercise price of the purchase option - if reasonably certain

- Termination penalties - if reasonably certain

The above is information is what the lessee has at the commencement of the lease that they are reasonably certain to exercise. Future market rent reviews, CPI & LIBOR increases cannot be accounted for at initial recognition as these increases are not known at the commencement of the lease.

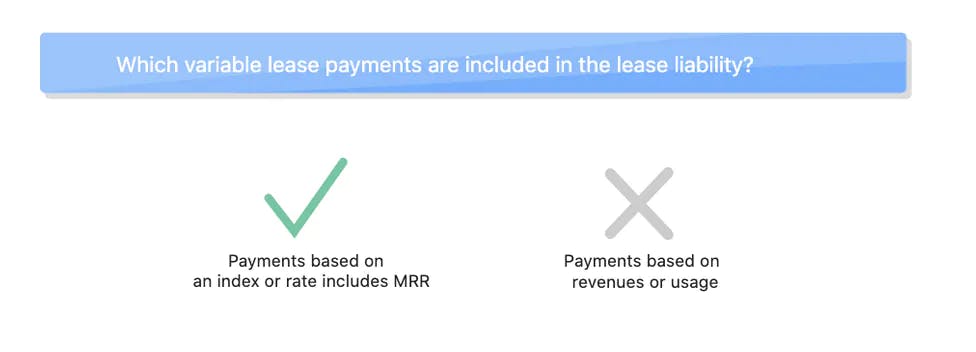

Variable lease payments

Known future variable payments are included in the initial recognition of the lease liability for more detail GASB 87.22 states:

Variable payments based on future performance of the lessee or usage of the underlying asset should not be included in the measurement of the lease liability. Rather, those variable payments should be recognized as outflows of resources (for example, expense) in the period in which the obligation for those payments is incurred. However, any component of those variable payments that is fixed in substance should be included in the measurement of the lease liability.

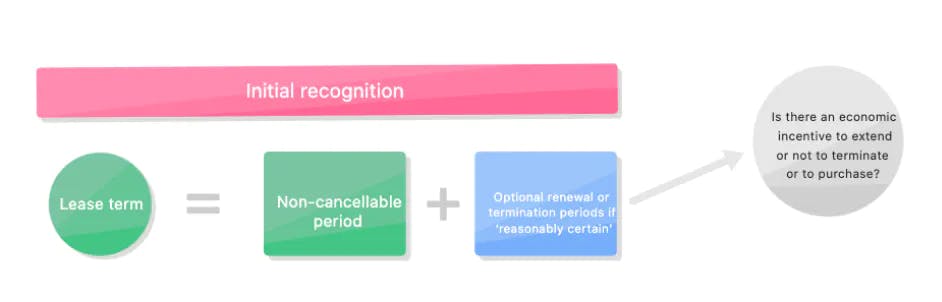

Lease Term

One of the key judgemental areas auditors will focus on is the lease term. The lease term starts when the lessee takes control of the underlying asset. It also includes any rent-free periods provided under the lease contract.

The term also consists of the non-cancellable period plus the periods the lessee is “reasonably certain” to renew. If the lessee is reasonably certain to terminate the lease that would mark the end date of the lease.

When determining “reasonably certain”, the lessee also takes into consideration if there are any ‘economic incentives’ to exercise or not exercise an option. For example, in a property lease, significant leasehold improvements were undertaken at inception that have significant economic benefits for the lessee over the period covered by the option period.

The lessee does not reassess the lease term unless a significant event or change in circumstances occurs that is within the lessee’s control.

Here's the applicable extract from the standard:

GASB 87.12. The lease term is the period during which a lessee has a noncancelable right to use an underlying asset (referred to as the noncancelable period), plus the following periods, if applicable:

- Periods covered by a lessee’s option to extend the lease if it is reasonably certain, based on all relevant factors, that the lessee will exercise that option

- Periods covered by a lessee’s option to terminate the lease if it is reasonably certain, based on all relevant factors, that the lessee will not exercise that

option - Periods covered by a lessor’s option to extend the lease if it is reasonably

certain, based on all relevant factors, that the lessor will exercise that option - Periods covered by a lessor’s option to terminate the lease if it is reasonably certain, based on all relevant factors, that the lessor will not exercise that

option.

Discount Rate

Once the lease payments & term are set, there’s one last input to finish the NPV calculation and that’s the discount rate. This input is highly judgemental which will mean your auditors will love understanding why you chose 3% instead of 3.5%.

Paragraph 23 of the standard instructs you to use the “rate implicit in the lease” charged by the lessor. However, if that can't be determined, it is acceptable to use the “incremental borrowing rate”.

Lessees are not required to apply the guidance for imputation of interest in paragraphs 173–187 of Statement 62 but may do so as a means of determining the interest rate implicit in the lease.

The rate implicit in the lease can be extremely difficult for the lessee to determine, as you need to understand within the lease payment you’re making, what portion is for using the actual asset and what portion is the interest (as you didn’t pay all up front).

The lessee's incremental borrowing rate is the rate that a lessee would have to pay on the initial recognition date of the lease for a loan of a similar term, and with similar security, to obtain an asset of similar value to the Lease Asset in a similar economic environment.

With the 3 inputs mentioned above, you get a lease liability, allowing you to now tackle the Lease Asset.

Lease Asset

The above diagram is a great illustration of what values you input into the measurement of the Lease Asset. We’ll now go through each of those inputs you need to consider when recognizing your lease asset on the balance sheet. It's paragrah 30 of the GASB 87 that explciitly details the follow inputs that are used to measure the value of the lease asset.

As per GASB 87.31 a lease asset should be amortized in a systematic and rational manner over the shorter of the lease term or the useful life of the underlying asset.

Lease Liability

As per GASB 87.30 a) This is what you’ve just worked out, the foundation of the Lease Asset is the NPV calculation of the lease liability. As a result, if your lease liability is wrong your Lease Asset will be too!

Incentives Before Commencement

GASB 87.30 b) Lease payments made to the lessor at or before the commencement of the lease term, less any lease incentives (as discussed in paragraphs 61 and 62) received from the lessor at or before the commencement of the lease term

Initial direct costs

GASB 87.30 c) Initial direct costs that are ancillary charges necessary to place the lease asset into service.

Transition options

If the lease starts after transition date, there’s no election to be made and you account for the lease following the above steps. For all leases that start before your transition date, GASB 87 is very clear of how those contracts should be accounted for.

Comparative/ Modified Retrospective Method

To adhere to the above requirements the standard is very clear. The standard should be applied retroactively by restating financial statements, if practicable, for all prior periods presented.

As per GASB 87.93 a lessee should be recognized and measured using the facts and circumstances that existed at the beginning of the period of implementation. If applied to earlier periods, leases should be recognized and measured using the facts and circumstances that existed at the beginning of the earliest period restated.

If restatement for prior periods is not practicable, the cumulative effect, if any, of applying this Statement should be reported as a restatement of beginning net position for the earliest period restated. In the first period that this Statement is applied, the notes to financial statements should disclose the nature of the restatement and its effect. Also, the reason for not restating prior periods presented should be disclosed.

Here's the applicable extract of the accounting standard GASB 87.93:

Changes adopted to conform to the provisions of this Statement should be applied retroactively by restating financial statements, if practicable, for all prior periods presented. If restatement for prior periods is not practicable, the cumu- lative effect, if any, of applying this Statement should be reported as a restate- ment of beginning net position (or fund balance or fund net position, as applicable) for the earliest period restated. In the first period that this Statement is applied, the notes to financial statements should disclose the nature of the restatement and its effect. Also, the reason for not restating prior periods presented should be disclosed.

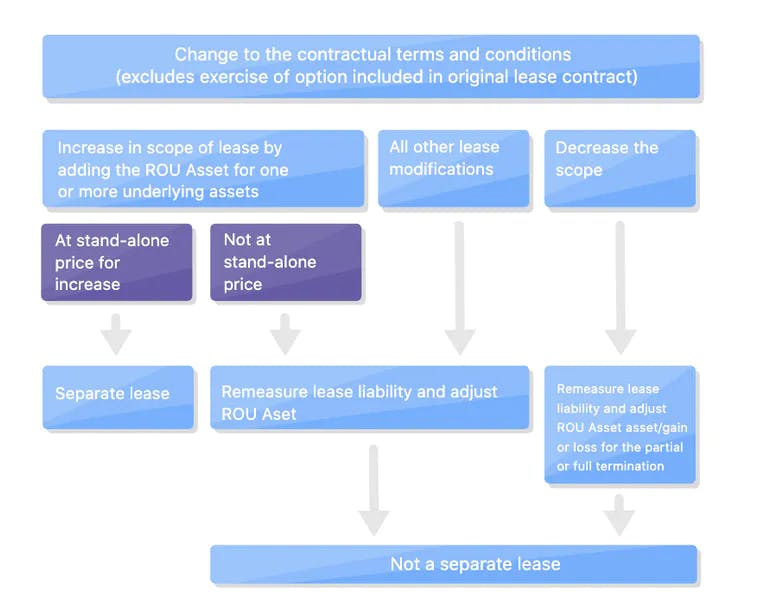

Subsequent measurement and modifications

A lease modification is a change in the scope of a lease or the consideration for a lease that was not part of its original terms and conditions. From a lease liability perspective, the key inputs that can be modified are:

- lease payments

- lease term

The standard classifies these contractual changes as either an increase or a decrease in scope. A decrease in scope is referred to as a partial termination in GASB 87. An increase in scope results in the lessee having greater access to the underlying asset(s) either due to an increase in term (control the asset for a longer period of time) or the scope of the asset has increased i.e. an extra vehicle. A partial termination is opposite to the above, the lessee has a decrease in the right to use the asset is the physical use i.e. one less vehicle.

Does the modification result in a new lease?

Before applying modification accounting, a key judgement needs to be made, does this result in a new lease?

As paragraph 73 of the standard states, a lessee accounts for a lease modification as a separate lease if both the following conditions exist:

- The modification results in the right to use one or more assets

- The increase in lease payments for the additional lease asset does not appear to be unreasonable based on (1) the terms of the amended lease contract and; (2) professional judgment, maximizing the use of observable information (for example, using readily available observable stand-alone prices).

If the above criteria are met, the lessee accounts for the modification as a new lease no different from any other lease.

If the conclusion is made that it is not a new lease, modification accounting is required.

Modification Accounting

The first thing to note is no matter the type of modification, it will result in an update to the value of the lease liability and asset. The crux of the adjustment is based on the present value of the updated future lease payments resulting from the modification of the sales agreement.

The accounting for increase and decrease in scope is slightly different, so the first step is to work out if it’s an increase or decrease in scope. As noted above, an increase in scope is either an increase in lease payments or term and a decrease is a reduction of one of the two. For example:

- Increasing the scope: Adding the right to use one or more underlying assets, for example, an extra floor of a building

- Decreasing the scope/partial termination: Removing the right to use one or more underlying assets – reducing the space rented in an office building.

- Increasing the scope: Extending the contractual lease term.

- Decreasing the scope/partial termination: reducing the lease term of the leased asset

Also, paragraph 27 states the lessee also should update the discount rate as part of the remeasurement if one or both of the following changes have occurred and the changes individually or in the aggregate are expected to significantly affect the amount of the lease liability:

- There is a change in the lease term.

- An assessment of all relevant factors indicates that the likelihood of a

purchase option being exercised has changed from reasonably certain to not reasonably certain, or vice versa.

Partial termination/Decrease in scope

When a decrease in scope occurs paragraph 77 of the standard states the lessee should account for an amendment during the reporting period resulting in a decrease in the lessee’s right to use the underlying asset (for example, the lease term is shortened or the number of underlying assets is reduced) as a partial or full lease termination.

In paragraph 78 it states the accounting treatment

A lessee generally should account for the partial or full lease termination by reducing the carrying values of the lease asset and lease liability, and recognizing a gain or loss for the difference.

The following examples will highlight how to calculate the gain/loss. It should be noted there is a different methodology for that of a decrease in term to an asset reduction.

Partial termination/Decrease in scope - decrease in term length

An example of this is the original lease agreement was 10 years, in year 2 of the lease it’s modified to 7 years. Correspondingly, the lease will now end in year 7, that’s 3 years less you no longer can access the Lease Asset. That decrease in scope would be calculated as 30% decrease (10 less 7 = 3 / 10 = 30%) in the Lease Asset.

Most importantly, with any decrease in scope, term length or reduction in asset size, the percentage decrease of the right to use the asset of the right of use asset must be captured.

Using Cradle with decreases in term length, we automatically calculate the decrease of the Lease Asset percentage for you.

A decrease in term length calculation methodology

There are two key aspects of the calculation:

- Calculate the gain or loss of the decrease in scope, which is driven by the difference between the Lease asset and lease liability applying the Lease Asset percentage decrease.

- The remeasurement of the lease liability using an updated discount rate.

The steps are:

- Calculate the Lease asset carrying value before modification

- Calculate and apply the Lease asset % reduction to the Lease asset

- Calculate the lease liability carrying value pre-modification & post modification using the current discount rate

- Calculate gain and loss: this is the balancing entry between the difference between the lease liability and Lease Asset.

- True up the lease liability based on a new discount rate based on the mvflp with the balancing side to the Lease Asset

That may seem confusing, so let’s walk through an example of how to calculate the decrease in scope for a reduction in the lease term.

Example 1 - decrease in scope: decreasing lease term

Dylan Ltd enters into a lease agreement with J Cash Private to rent 3 floors of commercial office space. The agreement commenced on 1 July 2019, with Dylan transitioning to GASB 87 on 1 January 2019. The length of the agreement is 5 years with $12,000 paid at the start of each year, the incremental borrowing rate for Dylan is 4%

At the start of year 2 (1/7/2020) Dylan continues to undergo major growth as a company and only requires the property until the end of year 3 (30/6/2022), the lessor J Cash Private agrees to these terms. The incremental borrowing rate at the time is 5%.

What are the initial recognition entries for the lease liability and Lease Asset at 1 July 2019?

| Date | Account | Debit | Credit |

|---|---|---|---|

| 1/7/2019 | Leaseasset | $55,554.06 | |

| Lease liability | $55,554.06 |

The above is the NPV of 5 payments of $12,000 over 5 years using a 4% discount rate

What are the entries for the decrease in scope lease term at 1/7/2020?

| Date | Account | Debit | Credit |

|---|---|---|---|

| 1/7/2020 | Lease liability | $21,762.63 | |

| Lease Asset | $22,242.93 | ||

| Gain/loss | $465.08 balancing entry |

| Date | Account | Debit | Credit |

|---|---|---|---|

| 1/7/2020 | Lease liability | $109.89 | |

| Lease Asset | $109.89 |

Workings:

Step 1 - Calculate Lease before modification

Calculate the carrying amount of Lease Asset value before modification $44,425.01

Lease Asset carrying amount at 1 July 2020

| Total days depreciation days at Initial recognition | 1827 | y |

|---|---|---|

| Lease Asset value at Initial recognition | $55,554.06 | x |

| Daily depreciation rate | $30.41 | y / x |

| 366 x $30.41 Depreciation per annum (1 July 2020 less 1 July 2019) |

$11,129.06 | z |

| Lease Asset | $44,425.01 | x - z |

Step 2 - apply the Lease asset % reduction

| Lease Asset | $44,425.01 | p |

|---|---|---|

| Remaining days before modification | 1461 | v |

| Remaining days after modification | 730 | j |

| % decrease of Lease Asset | 50.03% | (1 - j / v) |

| Lease Asset % amount | $22,227.71 | p x 50.03% |

Step 3 - calculate the lease liability pre and post-modification

Minimum future lease payments before modification

| Year 2 - 1 July 2020 | Year 3 - 1 July 2021 | Year 4 - 1 July 2022 | Year 5 - 1 July 2023 |

|---|---|---|---|

| $12,000 | $12,000 | $12,000 | $12,000 |

Discount rate: 4%

Net present value: $45,301

Minimum future lease payments after modification

| Year 2 - 1 July 2020 | Year 3 - 1 July 2021 |

|---|---|

| $12,000 | $12,000 |

Discount rate: 4%

Net present value: $23,538

Lease liability movement journal: $21,672.63 ($45,301-$23,538)

Step 4 - calculate the gain/loss

In this case the lease liability journal $21,762.63 is less then the Lease asset $22,242.93 therefore the difference $465.08 is a dr entry.

Step 5 - true-up of the lease liability

Apply the updated discount rate to the future lease payments post the modification

| Year 2 - 1 July 2020 | Year 3 - 1 July 2021 |

|---|---|

| $12,000 | $12,000 |

Discount rate: 5%

| Lease liability post modification | $23,538 | NPV using updated discount rate |

|---|---|---|

| Lease liability carrying amount | $23,429 | Step 3 |

| Journal | $109.89 | ($23,538 - $23,429) |

Partial termination/ Decrease in scope - asset size

The other type of decrease in scope is a decrease in asset size. For example, the original lease agreement was for 2 floors in a building, it turns out you only need one floor and renegotiates new terms with the lessor to remove the additional floor. This is a decrease in the scope of asset size, in this case, a 50% reduction of the Lease Asset. The standard has prescriptive guidance on how to account for these scenarios and like a decrease in the lease term, a gain/loss calculation to the profit and loss is required. Followed by a true-up of the lease liability using the latest discount rate.

The steps are:

- Calculate the Lease asset pre-modification

- Calculate the Lease asset % decrease and apply to Lease asset

- Calculate lease liability pre-modification amount & apply % asset decrease to lease liability

- Calculate the gain/loss

- True up the lease liability based on the mvflp

Example 2 decrease in scope - decrease in asset size

Aphex Enterprises enters into a lease agreement with JAAR Ltd to rent 3 floors of commercial office space. The agreement commenced on 1 July 2019, with Aphex transitioning to GASB 87 on 1 January 2019. The length of the agreement is 5 years with $12,000 paid each year at the start of each month, the incremental borrowing rate for Aphex is 4%

At the start of year 2 (1/7/2020) Aphex has to make three-quarters of their staff redundant, as a company and only requires 1 floor for the remainder of the term, the lessor JAAR Ltd agrees to a reduction in floor space with fixed payments being $375 per year. The incremental borrowing rate at the time is 5%.

What are the initial recognition entries for the lease liability and Lease Asset?

| Date | Account | Debit | Credit |

|---|---|---|---|

| 1/7/2019 | Lease Asset | $55,554,06 | |

| Lease liability | $55,554,06 |

What are the journal entries for the decrease in scope - asset size at 1/7/2020?

| Date | Account | Debit | Credit |

|---|---|---|---|

| 1/7/2020 | Lease liability | $30,351.73 | |

| Lease Asset | $29,764.75 | ||

| Gain/loss | $586.98 balancing entry |

| Date | Account | Debit | Credit |

|---|---|---|---|

| 1/7/2020 | Lease liability | $13,553.14 | |

| Lease Asset | $13,553.14 |

Workings:

Step 1 - Calculate Lease Asset before modification

| Total days depreciation days at Initial recognition | 1827 | y |

|---|---|---|

| Lease Asset value at Initial recognition | $55,554.06 | x |

| Daily depreciation rate | $30.41 | y / x |

| 366 x $30.41 Depreciation per annum (1 July 2020 less 1 July 2019) |

$11.129.06 | z |

| Lease Asset | $44,425.01 | x - z |

Step 2 - apply the Lease asset % reduction

| Lease Asset | $44,425.01 | p |

|---|---|---|

| Asset reduction | 33% | 3 years / 1 year |

| Apply % reduction | $14,660.25 | p x 33% |

| Journal | $29,764.75 | $44,425.01 - $14,660.25 |

Asset has reduced from 3 floors to 1 floor resulting in a 33% decrease.

Step 3 - calculate the lease liability pre-modification and apply Lease % adjustment

| Year 2 - 1 July 2020 | Year 3 - 1 July 2021 | Year 4 - 1 July 2022 | Year 5 - 1 July 2023 |

|---|---|---|---|

| $12,000 | $12,000 | $12,000 | $12,000 |

Discount rate: 4%

| Lease liability before modification | $44,301.09 | p |

|---|---|---|

| Asset reduction | 33% | 3 years / 1 year |

| Apply % reduction | $14,949.36 | p x 33% |

| Journal | $30,351.73 | $44,301.09 - $14,949.36 |

Step 4 - calculate gain/loss

Lease liability reduction a Dr of $30,551 whilst the Lease asset Cr is $29,764, as a result, the balancing entry will be a Cr of $586.98

Step 5 - lease liability true-up

| Year 2 - 1 July 2020 | Year 3 - 1 July 2021 | Year 4 - 1 July 2022 | Year 5 - 1 July 2023 |

|---|---|---|---|

| $375 | $375 | $375 | $375 |

Discount rate: 5%

| Lease liability after modification | $1,396.22 | NPV using updated discount rate and future payments |

|---|---|---|

| Lease liability value after Lease % | $14,949.36 | Lease Asset Carrying amount post asset % decrease |

| Journal | $13,553.14 | ($14,949.36 - $1,396) |

Based on the above remeasurement there is a debit to the lease liability of $13,553.14 and the balancing entry goes to the Lease asset.

Increase in scope

Assuming the modification does not result in a new lease, the lessee’s ability to use the Lease Asset has increased, unlike decrease in scope all increases are accounted for the same way, that is an increase in asset size i.e. leasing an additional floor of office space or increasing the term of the lease. When this occurs, the lessee remeasures the lease liability based on the updated future payments to be incurred, this will increase the liability and in turn, the other side of the journal (Dr) will go to increasing the Lease Asset.

Example 3 - increase in scope

Elvis Ltd enters into a lease agreement with Wonder Inc to rent 3 floors of commercial office space. The agreement commenced on 1 July 2019, with Elvis transitioning to GASB 87 on 1 January 2019. The length of the agreement is 5 years with $12,000 paid at the start of each year, the incremental borrowing rate for Elvis is 4%.

At the start of year 2 (1/7/2020) Elvis continues to undergo major growth as a company and requires 3 more floors, the lessor agrees to these terms with an increase to $24,000 per annum. The incremental borrowing rate at the time is 3%.

What are the initial recognition entries for the lease liability and Lease Asset?

| Date | Account | Debit | Credit |

|---|---|---|---|

| 1/7/2019 | Lease liability | $55,554,06 | |

| Lease Asset | $55,554.06 |

What are the journal entries for the increase in scope at 1/7/2020?

| Date | Account | Debit | Credit |

|---|---|---|---|

| 1/7/2020 | Lease liability | $46,585.58 | |

| Lease Asset | $46,585.58 |

Workings:

This figure is driven by the remeasurement of the lease liability

| Year 2 - 1 July 2020 | Year 3 - 1 July 2021 | Year 4 - 1 July 2022 | Year 5- 1 July 2023 |

|---|---|---|---|

| $24,000 | $24,000 | $24,000 | $24,000 |

Discount rate: 3%

| Lease liability after modification | $91,887.67 | NPV using updated discount rate & lease payments |

|---|---|---|

| Lease liability pre modification | $45,301.09 | NPV using previous discount rate & lease payments |

| Journal | $46,585.58 | ($91,887.67 - $45,301.07) |

Required Disclosures

When adhering to GASB 87.37 the following information must be presented in a company’s financial statements:

a) A general description of its leasing arrangements, including

(1) the basis, terms, and conditions on which variable payments not included in the measurement of the lease liability are determined and;

(2) the existence, terms, and conditions of residual value guarantees provided by the lessee not included in the measurement of the lease liability

b) The total amount of lease assets, and the related accumulated amortization, disclosed separately from other capital assets

c) The amount of lease assets by major classes of underlying assets, disclosed separately from other capital assets

d) The amount of outflows of resources recognized in the reporting period for variable payments not previously included in the measurement of the lease liability

e) The amount of outflows of resources recognized in the reporting period for other payments, such as residual value guarantees or termination penalties, not previously included in the measurement of the lease liability

f) Principal and interest requirements to maturity, presented separately, for the lease liability for each of the five subsequent fiscal years and in five-year increments thereafter

g) Commitments under leases before the commencement of the lease term

h) The components of any loss associated with an impairment (the impairment loss and any related change in the lease liability, as discussed in paragraph 34).

To adhere to these requirements sound processes are required in terms of catching the required information. Using Cradle who automates the majority of these disclosures e.g. roll forwards will save your time at year-end.