IFRS 16 Software

Take control of your reporting requirements

Remove the workload that comes with the AASB 16 / IFRS 16 standard

Automated Journals

Do your accounting in minutes

Input the details of the contract, run your journals, and your lease accounting is done. It’s as simple as that. Performing lease accounting manually will seem completely antiquated, and you’ll probably kick yourself for not using Cradle earlier.

As a lessee, to calculate a lease manually involves the following steps:

- Familiarize yourself with the new lease accounting standard. Understand the nuances of calculating a lease liability and right of use asset.

- Perform a lease liability calculation. Calculate the present value of the future lease payments at a point in time, ensuring you’ve captured all the relevant inputs to the calculation.

- Set up a right-of-use asset depreciation schedule. Use the lease liability value plus several other inputs prescribed by IFRS 16 / AASB 16.

- Each calculation needs to be updated any time there is a modification to the lease contract.

Then for monthly reporting, to calculate the journal entries, it is necessary to:

- Revisit each lease liability and right of use asset calculation.

- Ensure no accidental changes to the inputs of the spreadsheet.

- Calculate the movement of each account since the last month-end.

- Reconcile any differences.

- Adjust for FX movements.

Or you can use Cradle.

Intuitive Experience

A user interface that makes sense

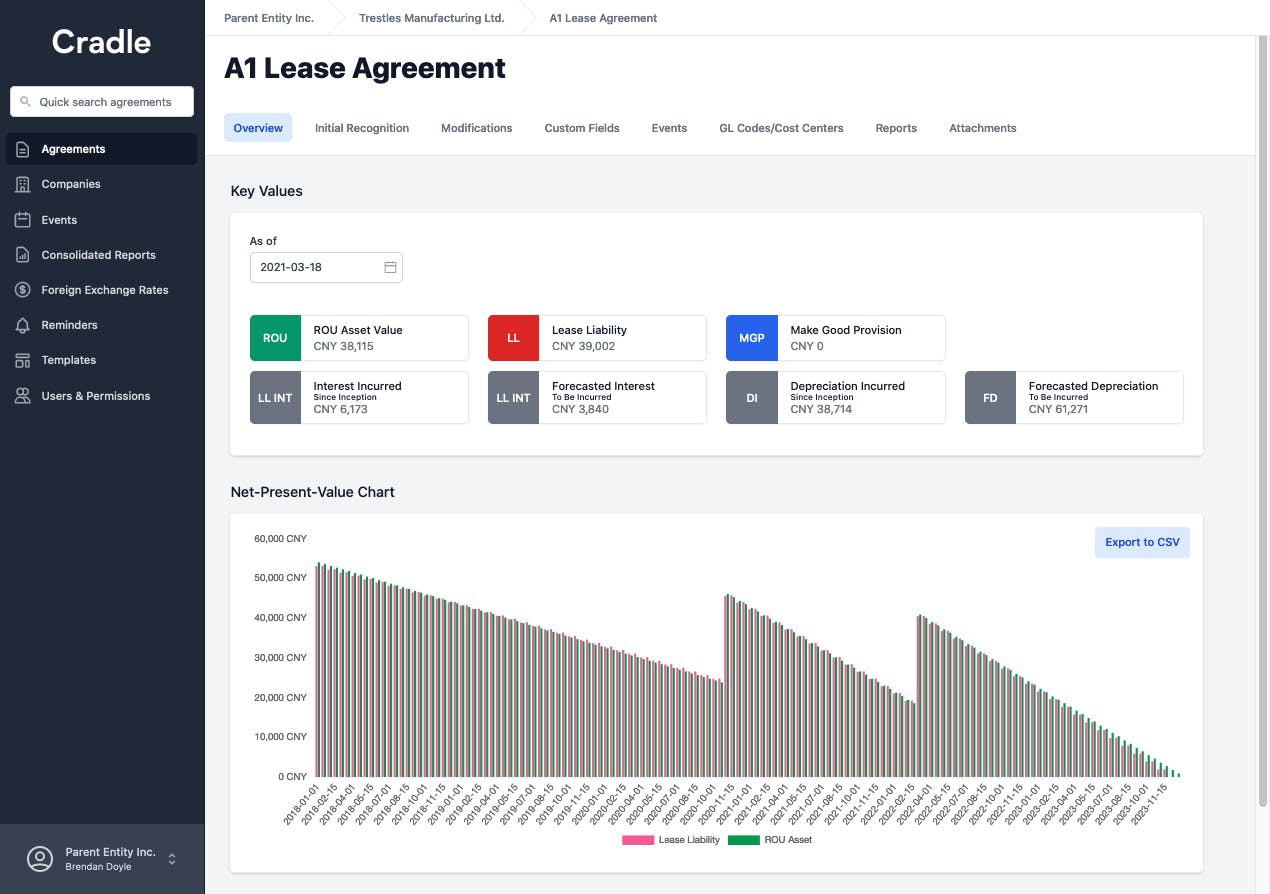

It’s easy to fall into the trap of assessing lease accounting software solely on a functionality basis. However, there is no point in having every lease accounting feature possible if the finance and other teams using the software can’t work out how to use it. Cradle is specifically designed so this does not happen.

We’ve done this by ensuring our IFRS 16 / AASB 16 software mirrors that of the standard. Start with the Initial Recognition tab, where the user must fill out all mandatory fields required to present value the future lease payments. Then move onto the inputs specific to the ROU asset. If you enter nonsensical data our validations will catch it, explain the error, and highlight the field that needs to be updated.

Once those details are set, you should only revisit the Initial Recognition page if there’s been an error in the entered data. Where do you make lease modifications? In the Modification tab. We’re so confident in our user interface we allow customers to sign up and onboard agreements themselves with no training. You can run your journals in no time. But if you do hit a roadblock, we have a bounty of help material from “How to input a CPI increase” to “I want to recalculate my lease agreement manually,” and if that does not suffice, our 24/7 customer support team is there to help you along the way.

Financial Reports

Everything you need to comply

There's no room for error when preparing a set of financial statements in compliance with the International Financial Reporting Standards (IFRS) / Australian Accounting Standard Board (AASB). Despite this, material errors continually occur in a set of financial statements. These errors will, on occasion, get past the company's auditors.

This is understandable given the finance team's sheer workload and the limitations of an audit, as it's impossible to audit everything.

Using Cradle's lease accounting software will mitigate the risk of material misstatement to a company's financial statements. The financial reports generated are uniform, secure, quick, and, most importantly, comply with the new lease accounting standards and the general principles of accounting.

With Cradle, you can generate all relevant financial reports related to your lease portfolio:

- Balance Sheet

- Income Statement

- Cash flow Statement

- Disclosure report

No matter your reporting calendar, Cradle can accommodate those reporting requirements. How? Cradle's calculations are performed daily. You have the ability to run your statements for any date ranges. Want to run your income statement for 7 days? You can do that. Cradle even gives the user the ability to drill down on account values at the start or end of the day. Even your auditors will be impressed. Don't worry; forecasting is also available. Want to gauge your total lease liability and right of use asset in 2025, no problems. Want to see what your cash flow statement will look like over the next ten years separated between financing and operating activities? Again no issues.

The final feature of our financial reports is that they can be run at any reporting level. Want to see the disclosure report of an individual agreement or a specific company, Cradle can accommodate that. Have a company structure with 50 subsidiaries and a total of 5,000 lease agreements and need the consolidated financial reports? Cradle will produce the reports in seconds.

Modification Accounting

Subsequent measurement taken care of

The financial reporting requirements of IFRS 16 / AASB 16 have been in effect long enough to be captured in most companies’ financial reporting cycles. It should come as no surprise that post-implementation requirements of the standards are just as arduous after the transition to IFRS 16 / AASB 16 when done manually. The time spent on the adoption of the new lease accounting standard is only the beginning and requires significant upkeep.

Any change to the leased assets expiry date or future lease payments impacts the lease liability and right of use asset. A simple CPI increase to the fixed payment amount will result in a remeasurement of the lease liability and right of use asset, but remember you do not have to update the discount rate.

There are many nuances in IFRS 16 / AASB 16 that can be missed when done manually. This even applies to lease accounting software solutions. As Deloitte states:

"Accounting systems will need to be able to cater for scenarios where remeasurement of the liability is required, potentially with an updated discount rate. Basic spreadsheet solutions may struggle to cope with such demands as well as identifying when such remeasurements are required."

The development team at Cradle couldn’t agree more. For example, different types of decrease in scope modifications will dictate different calculation methodologies. If you are curious about how Cradle’s modification accounting stacks up, refer to this article, which compares Cradle’s numbers to the IFRS 16 Illustrative Examples. You will quickly realize that even Excel is probably not IFRS 16 compliant.

Cradle is engineered to handle any modification of a leasing contract. Furthermore, we have records to ensure all users understand the modifications made to the applicable contract. Clean, simple and easy to understand. We are incredibly proud of our user experience for modification accounting and encourage our potential customers to compare this experience with other market solutions.

Sublease accounting

Lessor Accounting

If you're a lessor or lessee, Cradle can automate your lease accounting no matter your role in the new lease accounting standard. Sub-lease accounting is one of the most challenging areas under IFRS 16. A company needs to perform both lessee and lessor accounting. With Cradle, those requirements are a breeze.

No longer have two different software packages to manage your company's lessor leases and lessee leases. Instead, use Cradle and manage your entire lease portfolio in one place.

So if you're looking to implement efficiencies from the lessor perspective and want to automate the present value calculations required under a finance lease or you are a lessee that has entered into a sub-lease, Cradle can take care of it for you.

FX Accounting

Foreign exchange journals included

If you have several lease agreements in a foreign currency, the foreign exchange (FX) accounting can be as demanding as the lease accounting. In principle, FX accounting should be relatively straight forward. Delineate between if the account is monetary or non-monetary and use the applicable FX rate based on the rules set out in IAS 21 / AASB 121.

However, anyone that has done FX accounting knows things can quickly get confusing and convoluted despite the fact it’s merely converting one currency to another. That’s why we have FX functionality for lease accounting. When using Cradle, input the relevant FX rates, and those foreign leases will be converted to the applicable functional currency. Does your parent entity have a different reporting currency to a subsidiary’s functional currency? Cradle supports this as well.

Custom Fields

Organize your data the way you want to

The functionality requirements for lease accounting software are apparent; they're mandated by IFRS 16 / AASB 16.

But lease accounting is only one aspect of managing a lease portfolio. Under the previous lease accounting standard IAS 17 / AASB 117, the finance team only had to pay close attention to finance leases. Accounting for the remainder of the lease portfolio as operating leases was extremely straightforward.

This has all changed with IFRS 16 / AASB 16. Several teams within the organization need access to the information of a company's lease portfolio for various reasons. At Cradle, we understand this, and that's the reason why there's a clear divide between lease administration and lease accounting.

We also understand that every company's lease administration needs are different, and having a standardized experience would fall short of our customer's needs. So that's why we have an incredibly robust and customizable lease management system. Your lease administration can be tailored to suit your portfolio requirements. With Cradle, you can input any form of data and standardize this for the entire lease portfolio. All custom fields can be searched for, stratified and exported.

User Permissions

Set permissions on an individual user level

Microsoft Excel is an excellent tool when used for the right problem. From a lease accounting perspective, user permissions are another example of where Excel can fall short. Having to continuously maintain and update the same spreadsheet where multiple team members have access not only only compromises accuracy but it's also inefficient. Something as simple as a colleague updating the wrong version in which you spent the last four hours doing a lease accounting modification can set you back hours. Not to mention they're all password protected with "leaseABC". This is not the best practice from a financial reporting process perspective and it increases material misstatement risk.

On the other hand, Cradle has been specifically engineered to address these problems. Firstly, replicating a company's corporate structure, it allows ultimate flexibly to what teams manage what portfolios while maintaining oversight. Have a foreign subsidiary with a sizable lease portfolio. Add a superuser to that subsidiary and let them handle that specific lease portfolio.

Cradle brings the benefits of software to lease accounting.

Custom reports

Create the reports you need

A company's key metrics to manage its leased assets are unique to each company. At the most basic level, a company may want to view the balance sheet figures such as the lease liability and income statement, for example, depreciation with the expiry date of the lease. On the other hand, a company whose business centers around leasing assets may want a far more robust report to track inputs specific to their portfolio.

With Cradle's custom reporting, you can do this. There's no limitation to the report you can run.

Disclosures

Even the most tedious requirements are automated

Every company's finance team has to walk the tightrope between reporting the financial results that matter to the company while maintaining its regulatory financial reporting requirements. Juggling these two tasks doesn't get any more challenging than during year-end. Having to prepare a set of financial statements is exhaustive, not to mention they also need to get audited.

However, imagine that it's all done for your lease accounting, every aspect that will impact your financial statements. All you need to do is run the reports, and not only will you have the figures for your income statement, balance sheet, cash flow statement, but all the applicable disclosures as well. The auditors are also happy; you've given them access to your lease portfolio where they can access all relevant calculations and supporting documents. That should make things go a little more smoothly.

When using Cradle, this is the reality, no late nights trying to get the disclosure report done as it's always an afterthought. No negotiation of overruns with the auditors for time delays. Our disclosure report adheres precisely to the requirements of IFRS 16 / AASB 16 paragraph 53:

- depreciation charge for right-of-use assets by class of underlying asset;

- interest expense on lease liabilities;

- the expense relating to short-term leases accounted for applying paragraph 6. This expense need not include the expense relating to leases with a lease term of one month or less;

- the expense relating to leases of low-value assets accounted for applying paragraph 6. This expense shall not include the expense relating to short-term leases of low-value assets included in paragraph 53(c);

- the expense relating to variable lease payments not included in the measurement of lease liabilities;

- total cash outflow for leases;

- additions to right-of-use assets;

- the carrying amount of right-of-use assets at the end of the reporting period by class of underlying asset;

Modernize your lease accounting

Features

Automate repetitive, high-volume, and error-prone processes.

- Automated compliance

- Automate routine, high-volume, time-consuming tasks that are prone to human error. Just input the contractual details, and the applicable accounting judgements and your reporting will be done with a click of a button.

- Engineered to handle your portfolio

- No matter the lease terms or the type of modifications, Cradle's software architecture can handle most edge-case scenarios.

- Enhanced reporting processes

- Role-based user permissions, uniform calculations and the ability to track lease modifications. Using Cradle will standardize and streamline both your lease accounting and management of your portfolio.

- Integration

- Designed to complement existing financial systems. Replicate your general ledger structure in Cradle and export seamlessly.

- Consolidated reporting

- Our parent level reporting mirrors the principles of consolidated accounting, and it’s all automated. Whether you have one entity or hundreds across multiple currencies, your financial reports are accessible instantly.

- Foreign exchange accounting

- Increase accuracy and drive efficiencies when accounting for leases in foreign currencies. Input the applicable foreign exchange rates, and Cradle does the rest in adherence with IAS 21.

- Lease management

- We understand lease accounting is only one facet of your lease portfolio. Cradle also offers robust lease management, which is customizable to your organization's needs. Capture the information relevant to your business to ensure no critical date will be missed.

- Centralized documentation and search

- Attach and organize all applicable lease documents and find them in an instant when needed.

Calculation methodology

At Cradle, we sweat the details, so you don't have to. It all starts with the calculation methodology of how to present value the lease liability. There are various ways to calculate the present value of the future lease payments, even in Excel. To drill down even further within the present value formula, each aspect can get incredibly granular. We do daily calculations. That's the building block to ensure we can handle any lease scenario. There are considerations like what day count convention will be used to calculate the lease liability's interest. Excel's XNPV formula uses Actual/365 Fixed; while to get the same number as in the IFRS illustrative examples, the Actual/Actual ISDA day count convention will be needed. Does this matter? To you, maybe not, but to us, it's paramount.

In Cradle you have the choice of what calculation methodology to use for your lease accounting. Want to get the same numbers as the IFRS Illustrative examples? Select Actual/Actual ISDA. Want to be able to recalculate Cradle's numbers in Excel to the cent? Choose Actual/365 fixed.

All our calculations can be exported to a CSV file for your recalculations or for the auditors to look at.

On-boarding your lease portfolio

There's a variety of ways to get your lease portfolio data into Cradle. Whether you're looking to upgrade your current IFRS 16 / AASB 16 software, drive efficiencies and move away from Excel, or you're about to transition to the new standard, we offer a solution for you.

The options you have available are:

- Minimize costs, familiarize your team with the software and input the lease data yourself.

- Input the relevant lease information into our bulk upload template, and we'll do the rest.

- Let us handle the on-boarding. Team up with one of our partners, provide your lease contracts, and we'll input the data.

- If you're accounting for IFRS 16 / AASB 16 in Excel already, provide us with the spreadsheet, and we can take it from there. We'll even calculate your applicable top up journal entries.

- Already with another solution and not happy with the functionality or price? Our engineering team can come up with a custom solution to migrate your data into our system. Seamlessly integrated you'll think your lease accounting was always with Cradle.

Integration with your general ledger

Lease accounting is only one part of your financial reporting requirements. We understand it’s essential to get the information back to your general accounting ledger. As a result, you can set up Cradle to mirror your accounting environment. For each account in Cradle, you can set a general ledger code to match that used in your accounting system. If you have multiple cost centres using the same leased asset or account, you can also weigh general ledger codes.

Customer success

Your success is our success, and we want to ensure we provide all relevant resources to navigate and account for your lease portfolio. Part of your subscription includes 24/7 access to our customer support team. Our team has experience with the standard and are qualified chartered accountants. We're well equipped to answer any questions that arise. So if you hit a roadblock, we're always there to help.

Furthermore, when signing up, you'll get specialized training based on the needs of your lease portfolio. This provides an excellent opportunity to discuss best practices and how best to get the most out of our AASB 16 / IFRS 16 lease accounting software.

The last aspect of our customer success offering is access to a huge selection of documents and videos of "how to's" in Cradle. This goes beyond using our software and helps navigate the standard. Let's say you're unsure of what a non-lease component is. Click on our help button, and you're directed to an in-depth explanation with details of the impacts of utilizing the practical expedient offered by IFRS 16 / AASB 16 on your lease liability and ROU asset.