The Required Disclosures for a Lessee Under ASC 842

Introduction

ASC 842 comes as the successor of ASC 840 (the previous standard for accounting for a lease). It deals with the leases undertaken by entities (both private and public) across all industries. While the accounting from a lessor perspective remains broadly unchanged, the accounting requirements for lessees see a significant change under ASC 842.

Per ASC 842, for any lease that is longer than 12 months, lessees are now required to apply a balance sheet model to their lease accounting. A lessee needs to recognize a liability and asset related to the specific lease.

Additionally, this standard also promulgates significant changes in the complex areas of lease accounting like sales and leasebacks, build-to-suit leasing arrangements, etc.

In this article, we will go through the disclosure requirements set forth by ASC 842. But before that, let’s make sure we are clear on the objective of these disclosure requirements. Why does the standard even require them? The following excerpt from ASC 842-20 offers a quick insight into the core objective of its disclosure requirements:

50-1 The objective of the disclosure requirements is to enable users of financial statements to assess the amount, timing, and uncertainty of cash flows arising from leases.

Disclosure requirements under ASC 842 are intended to offer the financial statement users a better understanding of the entity’s leasing activities. Particularly, a better understanding of the amount, timing, and uncertainty of lease cash flows.

This will then enable better assessment of the lease position of the Company and ultimately, help better and more informed decision-making by the users of financial statements.

The standard doesn’t stop here. The next half of the same paragraph (reproduced below) briefly outlines how this objective is to be met.

To achieve that objective, a lessee shall disclose qualitative and quantitative information about all of the following:

a. Its leases

b. The significant judgments made in applying the requirements in this Topic to those leases

c. The amounts recognized in the financial statements relating to those leases

Let us now delve into the further details of the disclosure requirements of this standard to better learn what the standard requires.

Where To Start

Paragraph 50-1 above clearly demonstrates that the disclosures required by ASC-842 can be broken down into two broad categories:

Quantitative Disclosures

The main purpose of quantitative disclosures is to supplement the amounts recorded in the financial statements so that the users of financial statements can better understand the leasing activities of the Company.

We'll cover each required quantitative disclosures in detail below.

Qualitative Disclosures

Qualitative disclosures will take a narrative form and provide general information about the leasing position of a Company.

ASC 842 lays down an extensive list of qualitative disclosures that must be provided by the lessee. Starting from a general description of the leasing activities of the Company to the basis and terms of the leases, the significant policies adopted by the Company in respect of leases, and so on.

Where do you get these disclosures? Most of this information would be readily available in a Company’s lease agreements that you’d have to sift to know the disclosable highlights of your lease arrangement. Additionally, you’d have to revert to an entity’s accounting policies to complete the remaining disclosures.

Materiality of Disclosures

Para 20-50-2 of ASC 842 states that:

A lessee shall consider the level of detail necessary to satisfy the disclosure objective and how much emphasis to place on each of the various requirements. A lessee shall aggregate or disaggregate disclosures so that useful information is not obscured by including a large amount of insignificant detail or by aggregating items that have different characteristics.

The disclosure requirements of ASC 842 are much more complex and comprehensive than that of ASC 840 and meeting them all can be a significant challenge. Particularly, the fact that new disclosure requirements are extensive and open-ended but, more is not necessarily better.

Entities now need to consider the materiality of their disclosures much more than before. Disclosing immaterial information will be a waste of time for companies and users of financial statements. And over-aggregation runs the chance of obscuring the disclosures that matter.

What is the appropriate level of aggregation / disaggregation? The answer to this question will be unique for every entity based on its set of circumstances.

Some examples are:

→ If an entity leases two broad types of assets, say equipment and machinery, it might be appropriate to disaggregate disclosures at the "class of asset” level.

→ If an entity leases for 5-10 years and 10 or more years, it may disaggregate its leases based on the “lease term”.

→ An entity that has significant variable terms for some leases and fixed lease payments for others, it may be appropriate to disaggregate them on the basis of lease payment terms.

Quantitative Disclosures required by ASC 842

Let’s begin with what’s more extensive and complex – the quantitative disclosure requirements of ASC 842 for lessees.

The standard requires for each period presented in the financial statements, a lessee shall disclose the following amounts relating to a lessee’s total lease cost, which includes both amounts recognized in profit or loss during the period and any amounts capitalized as part of the cost of another asset by other Topics, and the cash flows arising from lease transactions:

| Item | Disclosure |

|---|---|

| (a) | Finance lease cost, segregated between the amortization of the right-of-use assets and interest on the lease liabilities |

| (b) | Operating lease cost |

| (c) | Short-term lease cost, excluding expenses relating to leases with a lease term of one month or less |

| (d) | Variable lease cost |

| (e) | Sublease income, disclosed on a gross basis, separate from the finance or operating lease expense |

| (f) | Net gain or loss recognized from sale and leaseback transactions |

| (g) |

Amounts segregated between those for finance and operating leases for the following items:

|

Finance Lease Cost

Let us now break down each of these requirements to see how a lessee can prepare them.

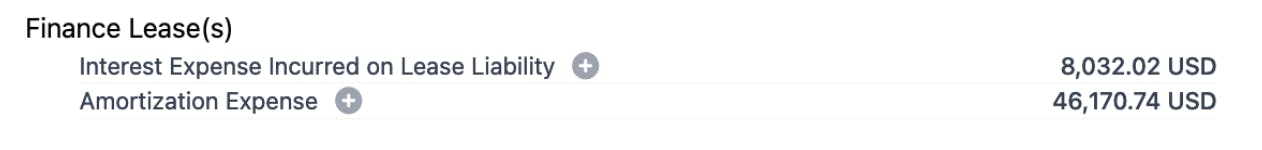

(a) Finance lease cost, segregated between the amortization of the right-of-use assets and interest on the lease liabilities

One notable difference brought about by ASC 842 is in the accounting treatment of leases from the lessee’s perspective where all its leases (finance or operating) must appear on the balance sheet.

However, the lease expenses for both these lease types appear differently in the income statement. The lease cost for the finance lease is split into amortization and interest expense for the lease and appears under the respective titles of Amortization and Interest Expense in the income statement.

The lessee needs to disclose this cost disaggregated between amortization and interest expense.

Here’s an example this:

Operating Lease Cost

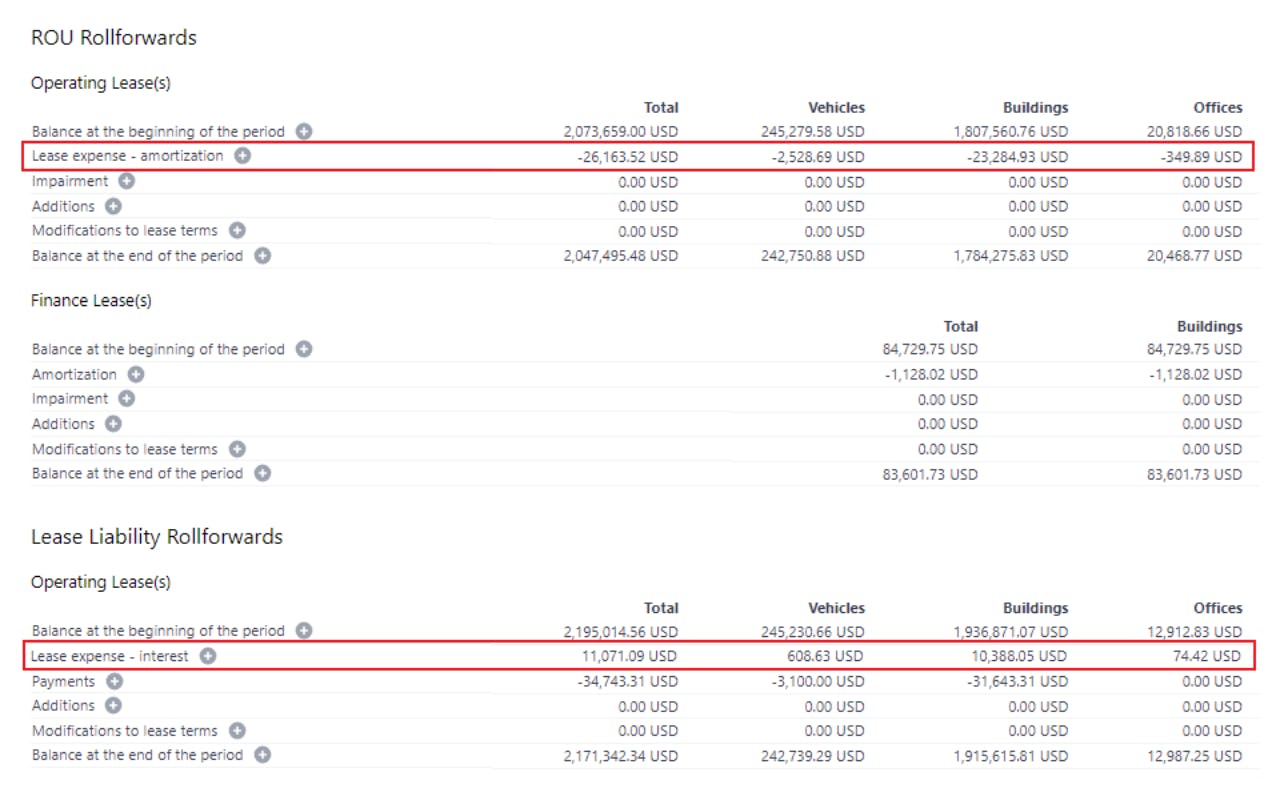

Unlike the finance lease cost that’s split between interest and amortization in the income statement, ASC 842 requires the entire operating lease cost to appear as Lease Expense.

There’s no need to segregate the lease cost for an operating lease between amortization and interest expense. Just disclose the aggregated expense for an operating lease recorded in the income statement for the periods presented.

For example, Cradle’s lease accounting software displays this financial reporting requirement. You can find both the components for your operating cost from the Lease Liability and ROU Asset Roll Forward schedule as below:

Short-term Lease Cost

ASC 842 allows three practical expedients to lessees. One of these is to not apply the requirements of ASC 842 if the lease term is less than 12 months.

In such a case, the lessee can simply record the lease payments as an expense and that’s it. We call such a lease a short-term lease (a lease for a term of more than one month and less than 12 months).

The expense incurred in a period in respect of short-term leases must be disclosed. By running Cradle report, you will find the short term lease cost as a part of your expense for scope-exempt leases.

Variable Lease Cost

Variable lease payments can be of two types –

- Payments linked to an index or rate (included in the lease liability on initial recognition)

- Payments based on a certain % of revenue, or based on a future change in an index rate, etc. (not known and not included in the lease liability on initial recognition)

The second type of variable payments cannot be known by the lessee in advance (like you cannot know the exact amount of revenue you’d generate in the coming year). These are not included in the present value of the lease liability and are simply recorded as an expense later.

Such variable lease payments that are expensed when incurred are to be disclosed by the lessee as follows:

Sublease Income

Sublease simply refers to the situation where a lessee subleases its leased asset to a sub-lessee. So technically, the lessee wears the hat of a lessor (from the perspective of the sub-lessee) and at the same time acts as a lessee to the head lessor.

The income derived from such a sublease is called sublease income.

ASC 842 requires sublease income to be separately disclosed by the lessee on a gross basis. This means it must not be net off with the lease expense incurred on that lease (finance or operating) by the lessee.

For example, if a lessee has taken a property on lease payments of $10,000 per year and then leases it further for $12,000 per year, he must disclose $12,000 as the sublease income. Standard doesn’t allow the netting off the sublease income of $12,000 with the lease expense of $10,000 to disclose a net sublease income of $2000.

Here’s an example of this:

Net Gain or Loss Recognized from Sale and Leaseback Transactions

Whatever net gains or losses have been incurred by a lessee on the sale and leaseback transactions undertaken during the presented periods are to be disclosed under this requirement.

As a lessee, if you have made a gain on the sale and leaseback transaction for Asset A and a loss on the sale and leaseback transaction for Asset B, set them off and show what you got on net.

A sale and leaseback transaction occurs when a lessee sells an asset to a lessor and immediately leases it back. So, the control of the asset remains with the lessee, and a block of cash is released (as sale proceeds) for the lessee.

Amounts Segregated Between Those for Finance and Operating Leases

All the items that we discuss next warrant disclosures sufficiently disaggregated for operating and finance leases.

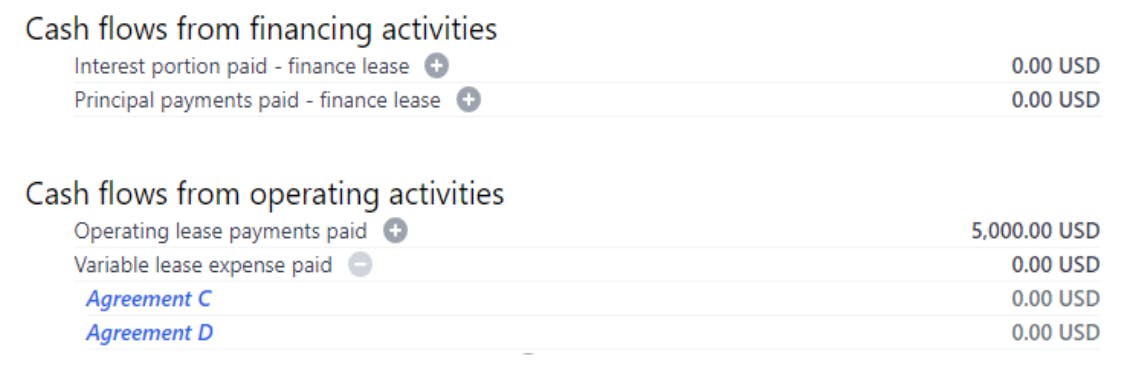

1. Cash paid for amounts included in the measurement of lease liabilities, segregated between operating and financing cash flows

Keep track of the cash outflows made during the year against lease liabilities. These need to be disclosed. The periodic lease payments made by lessees to settle lease liabilities are covered under this requirement. However, here’s the catch.

The cash flows related to an entity’s lease liabilities would already be appearing in its statement of cash flows under the relevant activity line (operating or financing activities probably). If they appear there (as a separate line item), this disclosure requirement stands satisfied.

However, it is better to disclose these numbers separately and mandatory if not already disclosed in the statement of cash flows. Like below.

Supplemental Non-Cash Information on Lease Liabilities Arising from Obtaining Right-of-Use Assets

ASC 842 requires lessees to disclose supplemental noncash information on the lease liabilities arising from obtaining ROU Assets. While this requirement might take you a while to digest, let us break it down here for you.

When an asset is leased, the lessee books a lease liability and an ROU Asset (forget the lease payments made on the lease commencement, if any). In short, he obtains an ROU Asset and books a lease liability, but no cash receipt or payment takes place.

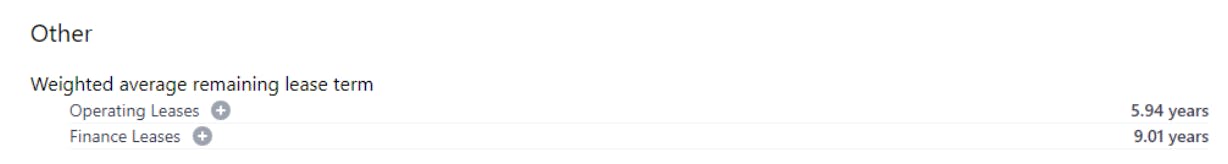

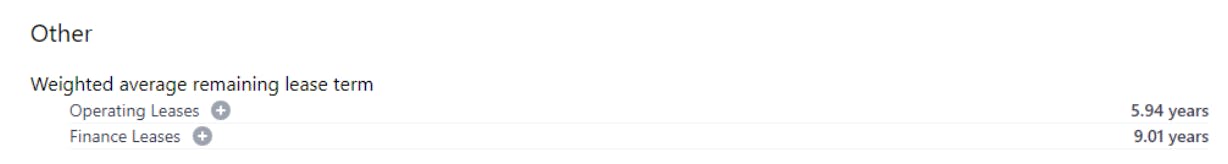

Weighted-Average Remaining Lease Term

One of most time consuming requirements under ASC 842 is lessees are required to calculate and disclose the weighted average remaining lease term for all their leases (separately for operating and finance leases).

Para 842-20-50-5 refers to Para 842-20-55-11 for guidance on preparing the weighted-average remaining lease term disclosures, which states that:

The lessee should calculate the weighted average remaining lease term based on the remaining lease term and the lease liability balance for each lease as of the reporting date.

In Cradle, this required disclosure takes literally a second:

Weighted-average Discount Rate

In addition to the weighted average lease term, lessees also need to calculate and disclose the weighted average discount rate separately for their operating and finance leases.

Para 842-20-50-5 refers to Para 842-20-55-12 for guidance on preparing the weighted-average discount rate disclosures, which states that:

The lessee should calculate the weighted average discount rate based on both of the following:

a. The discount rate for the lease that was used to calculate the lease liability balance for each lease as of the reporting date;

b. The remaining balance of the lease payments for each lease as of the reporting date.

Again, in Cradle this disclosure is ready right out of the box:

Tip!

It is advisable to provide the disclosures discussed above in a tabular format in your financial statements. Not that ASC 842 specifically mentions that, but this is a guidance that comes between the lines.

An excerpt from 842-20-50-5 says “- - - See Example 6 (paragraphs 842-20-55-52 through 55-53) for an illustration of the lessee quantitative disclosure requirements in paragraph 842-20-50-4.”

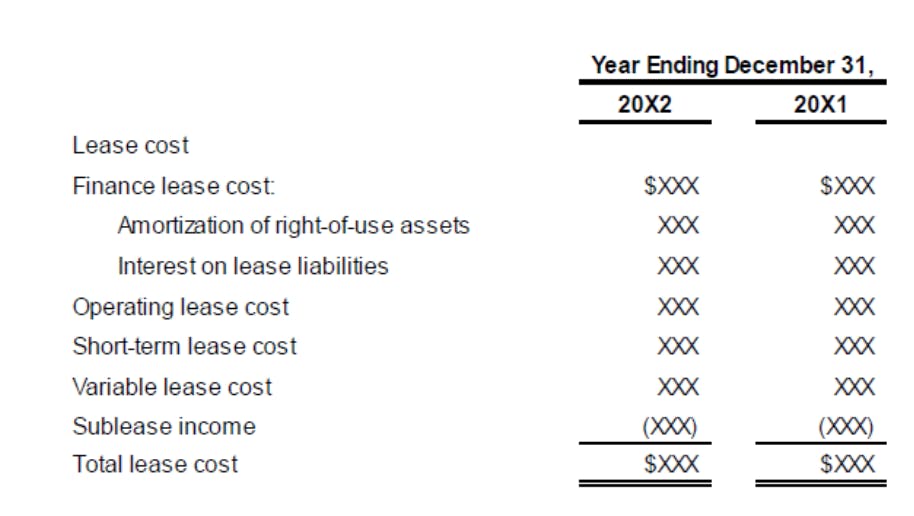

Here’s Example 6 from ASC 842

Maturity Analysis

With this, we have covered almost all the quantitative disclosures required by ASC 842 except for one major disclosure – the lease maturity analysis.

The first half of Para 20-50-6 of ASC 842 says:

A lessee shall disclose a maturity analysis of its finance lease liabilities and its operating lease liabilities separately, showing the undiscounted cash flows on an annual basis for a minimum of each of the first five years and a total of the amounts for the remaining years.

A lease maturity analysis breaks down the yearly lease payments that fall due in the coming years. Lessees need to prepare a maturity analysis for their lease liabilities keeping in mind the following two emphasis points:

- Separate for finance and operating leases

- Disaggregation of yearly undiscounted cash flows for each of the upcoming five years and beyond.

The maturity analysis for lease liabilities will come out automated from your leasing software. Here’s an example from Cradle of what a Maturity Analysis disclosure looks like

A lessee shall disclose a reconciliation of the undiscounted cash flows to the finance lease liabilities and operating lease liabilities recognized in the statement of financial position.

After we have made a maturity analysis for the undiscounted lease cash flows, the next step is to disclose a reconciliation between the undiscounted cash flows and the lease liability appearing in the financial statement.

The difference between these two figures is the discounting we perform on initial recognition (the effective interest). You do not need to make a lot of additional effort to provide this reconciliation.

To perform this reconciliation, pick the amount of total undiscounted lease liabilities from the Lease Maturity Schedule above. From this figure, deduct the amount of total lease liability as at the year end.

Qualitative Disclosures required by ASC 842

Let's now move on to the qualitative disclosures required from lessees.

As we continue to explore the qualitative disclosures of this codification, you’ll notice that ASC 842 is quite focused on qualitative disclosures and there’s a long list that needs compliance.

| Section | Disclosure Requirements |

|---|---|

| (a) Nature of Leases |

|

| (b) Leases Not Yet Commenced | Information about leases that have not yet commenced but that create significant rights and obligations for the lessee, including the nature of any involvement with the construction or design of the underlying asset. |

| (c) Significant Assumptions and Judgments |

|

A General Description Of Those Leases

There’s a lot of information that a lessee must disclose about its leases, all of which should be consistent with the disclosure objective of ASC 842. All these disclosures are going to be in a narrative form (a descriptive text).

The term “general description” is a broad term, and the standard is not very clear on how general or how detailed this description has to be. Providing the appropriate level of detail to make sure this requirement is complied with adequately is your call.

Some general questions that you can ask yourself before you begin drafting this disclosure include:

- What classes of assets have you leased?

- What are the terms of the lease (lease period, basis, etc.)?

- How are these leased assets used by the lessee?

- Are these leased assets of a general or a specialized nature?

- Why does the lessee lease these assets?

This list is not exhaustive but gives you an idea of the areas to be covered under a general description of leases. Here’s an example of this: “The Company has lease arrangements for certain land and buildings for many of our retail stores, office facilities, and Supply Chain Network facilities, as well as equipment. These retail store leases typically have a lease term of 15 to 30 years, rack store leases have a lease term of approximately 10 years, and the office and supply chain network facilities’ usually have an original lease term of 5 to 20 years.”

The Basis and Terms and Conditions on Which Variable Lease Payments Are Determined

As discussed above, variable payments can be of two types:

1) Linked to an index or rate

2) Not linked to an index or rate

Variable payments that are linked to an index rate will already be included in the lease liability and ROU Asset whereas the other type is not.

Keeping in mind the disclosure objective of the subject codification i.e., “to enable users of financial statements to assess the amount, timing, and uncertainty of cash flows”, it is important to disclose the type of variability in cash flows.

A lessee should disclose the type of variability that exists in his lease contracts, how it is determined, and the terms and conditions for it. This explanation should be the same for both types of variabilities (included and not included in the lease liability measurement). This should help the users understand the uncertainty in future cash outflows.

Here's an exemplary disclosure for this:

“Variable lease cost includes payments for variable common area maintenance charges and additional payments based on 2% of sales generated from each store, which are recognized when probable. Such amounts are not included in the measurement of lease liabilities”

The Existence And Terms And Conditions Of Options To Extend Or Terminate The Lease

3. The existence and terms and conditions of options to extend or terminate the lease. A lessee should provide narrative disclosure about the options that are recognized as part of its right-of-use assets and lease liabilities and those that are not.

Disclosing the options to extend or terminate the leases offers more transparency to users on the rights and obligations of the lessee and helps them understand the future cash flows of the lessee in case these options are exercised.

An example of this disclosure is as follows:

“Some of our leases, primarily for transportation and office equipment, come with a renewal option for periods ranging from two to five years. Because the Company is not reasonably certain to exercise these renewal options, the options are not considered in determining the lease term and associated potential option payments are excluded from lease payments. The Company’s leases generally do not include termination options for either party to the lease”

The Existence and Terms and Conditions of Residual Value Guarantees

4. The existence and terms and conditions of residual value guarantees provided by the lessee.

Under this requirement, the lessee must explain the terms and conditions of any residual value guarantees included in its leases. Residual value guarantees represent a commitment from the lessee that the asset would have the guaranteed residual value upon the lease return of the asset to the lessor.

In case the asset is less in value than the guaranteed amount at the end of the lease, the difference will be compensated by the lessee. It is important to disclose this as this may hit the lessee’s future cash outflows.

For example:

“We have extended residual value guarantees amounting to $ 5.7 billion in respect of the leases of our office spaces. We will probably owe $1.5 billion under the said guarantee and therefore, the same is included in our lease liability and ROU Asset”

Or

“Our lease agreements do not contain any material residual value guarantees.”

The Restrictions or Covenants Imposed

5. The restrictions or covenants imposed by leases, for example, those relating to dividends or incurring additional financial obligations.

A lease agreement may impose several restrictions on the lessee. These might include restrictions on issuing dividends, obtaining further loans / running credit facilities, sub-leasing the leased asset further and so on.

Going through your lease agreement will help you identify these. An example of how you can disclose these restrictions is reproduced here.

“Our equipment lease agreements include some material restrictive covenants that restrict us from subleasing it further. It also restricts our credit facility by $200 million if our lease liabilities, at any time, exceed $500 million”

a. A lessee should identify the information relating to subleases included in the disclosures provided in (1) through (5), as applicable.

If you also have subleases, make sure to provide all the above disclosures for such subleases too, where considered appropriate.

b. Information about leases that have not yet commenced but that create significant rights and obligations for the lessee, including the nature of any involvement with the construction or design of the underlying asset.

This requirement covers the leases that will affect the lessee’s future cash flows but do not appear on the balance sheet yet. These could be:

- Forward starting leases (contracted but not commenced)

- Leases where the leased asset is under specialized construction and the lessee is involved in it.

For example:

“We have entered a lease arrangement to construct our main supplies factory in XYX city. The design and specifications of the factory space are framed by us and it is yet under construction by the lessor. The lease is expected to commence in 20X8 after the construction is complete.”

c. Information about significant assumptions and judgments made in applying the requirements of this Topic, which may include the following:

- The determination of whether a contract contains a lease

- The allocation of the consideration in a contract between lease and non-lease components

- The determination of the discount rate for the lease

This disclosure requirement is all about the significant assumptions and judgments a lessee has made in identifying a lease contract (for example if a lessee has made a significant judgment in determining that there doesn’t exist a substantive substitution right, a disclosure is warranted).

Similarly, the judgment is used to identify the basis for allocating consideration to lease and non-lease components. For example, the estimation of stand-alone selling prices. And the judgments used in determining the appropriate discount rates (like the incremental borrowing rate).

The disclosure requirement for these assumptions and judgments may not always be applicable.

Here is an example of this:

“For our office equipment leases, we have determined not to separate lease and non-lease components. Maintenance services are provided by the lessor at a fixed cost and are included in the fixed lease payments for the single, combined lease component. We have also elected to discount our office equipment lease liabilities using a risk-free rate.”

Other Disclosures

Broadly, the list of quantitative and qualitative disclosures required by ASC 842 has come to an end, but there are still some other requirements of the codification that we’d like to walk you through.

Lease Agreements with Related Parties

Extract 842-20-50-7 of ASC 842 requires that A lessee shall disclose lease transactions between related parties by paragraphs 850-10-50-1 through 50-6.

To disclose the lease transactions carried out with its related parties, a lessee must cover the following aspects to meet this disclosure requirement:

- Nature of the related party relationship;

- Nature of the lease; and

- The terms of the lease are influenced by the relationship.

Here’s an exemplary disclosure:

“The Company has leased a building from an executive officer of the Company. The original term of the lease is 5 years expiring in 2028 with a renewal option ranging from 3 to 5 years. The lease has been classified as a finance lease. The total lease cost associated with this lease for the year ended December 31, 2023, was $40,000”

Short-Term Lease Considerations

Para 842-20-50-8 of the codification states that:

A lessee that accounts for short-term leases by paragraph 842-20-25-2 shall disclose that fact. If the short-term lease expense for the period does not reasonably reflect the lessee’s short-term lease commitments, a lessee shall disclose that fact and the amount of its short-term lease commitments.

Curious to know what the referred para (842-20-25-2) says. It refers to the short-term lease exemption allowed to lessees. Lessees have the choice to apply the exemption of not booking a lease liability and a ROU Asset for a lease of less than 12 months and they can make this choice for each class of assets.

This disclosure requires a lessee to disclose the fact that he has applied for the short-term lease recognition exemption. Additionally, a lessee must disclose the amount of its short-term lease commitments if it’s not adequately reflected in the short-term lease expense otherwise.

For example:

“The Company has elected to apply the short-term lease exemption for its leases of office equipment. The short-term lease cost for the year amounts to $300,000 in 20X1. During the year, the Company has entered into a master agreement for new office equipment that also qualifies for the short-term lease exemption. Hence, the short-term lease cost for the year doesn’t reasonably reflect the Company’s short-term lease commitments that amount to $2,450,000.”

Lease and Nonlease components

Assume you’re a lessee in a lease arrangement for the lease of a building with annual lease payments of $5,000. However, together with the building you also get maintenance services (security, cleaning, etc.).

The lease of a building is a lease component. Whereas, the maintenance services make a non-lease component. The annual lease payment of $5,000 includes the payment for both these components. As a lessee, you can allocate the consideration of $5,000 to the lease and non-lease components based on the stand-alone selling price for them both.

The codification also allows you to apply the practical expedient of not separating these components. In this case, the entire consideration of $5000 will simply be treated as the consideration for the building’s lease.

However, if you apply this practical expedient, here is a disclosure requirement that you must comply with.

Excerpt 842-20-50-9 requires that if a lessee elects the practical expedient on not separating lease components from non-lease components in paragraph 842-10-15-37, he shall disclose its accounting policy election and which class or classes of underlying assets it has elected to apply the practical expedient.

Easy enough? Let me show you an example of how you can do this:

“For machinery leases, the Company has elected not to separate lease and non-lease components. The repair & maintenance services are provided by the lessor at a pre-decided cost per annum. This cost is included in the fixed lease payments that are treated as a single, combined lease component.”

Example 1: Quantitative Disclosures

How about we now consolidate all the knowledge that we have seen above?

We are now going to dive into an example of some lease agreements (entered from the perspective of a lessee) and disclosures to be given to them.

Assume the year-end for our financials to be 31 December 2023.

Operating Lease: Equipment 1

- Lease commencement date: 1 January 2022

- Lease end date: 31 December 2027

- Payments: $4,500 annually (paid at year-end; accruals)

- Discount Rate: 6%

- Lease Term: 6 years

Finance Lease: Equipment 2

- Lease commencement date: 1 January 2023

- Lease end date: 31 December 2030

- Payments: $2000 annually (paid in advance at year start)

- Discount Rate: 10%

- Lease Term: 8 years

- ROU Asset:

- - as of 01 January 2023: $11,737

- - as of 31 December 2023: $10,060

- Lease Liability:

- - as of 01 January 2023: $11,737

- - as of 31 December 2023: $10,701

Other Information:

- Lease payments made against short-term leases during the year: $1,500

- Variable lease payments made during the year include $5000 paid as 2% of the sales of the output produced from Equipment 2.

- Lease income on subleasing of assets: $6,000

- Gain on Sale and leaseback transactions entered during the year: $1,570

Total Lease Cost

One big chunk of the ASC 842’s mandatory disclosures will come from the following table for lease cost. Example 6 of the codification provides this table.

Using the data in the example above for both the operating and finance leases, we have prepared it as follows:

The table satisfies the quantitative disclosure requirements of ASC 842-20-50-4-(a) through 842-20-50-4-(e).

The following article how to calculate a finance lease under ASC 842, covers all the details on how to calculate the lease liability, the interest cost, the amortization, and so on.

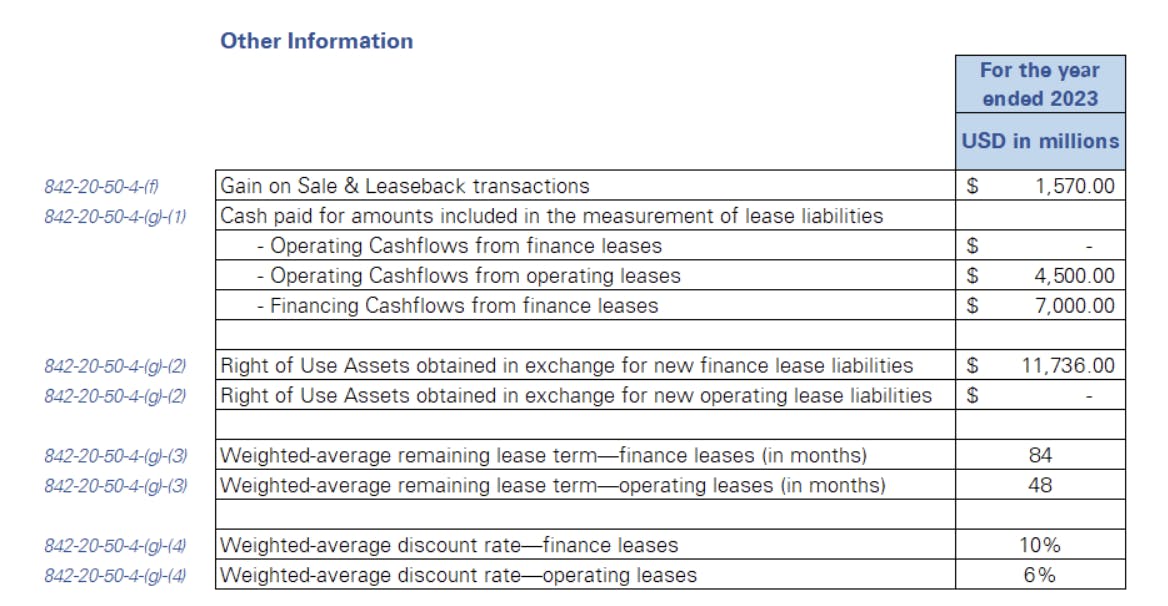

Other Quantitative Disclosures

After we have populated the lease cost table, next we need to prepare the other quantitative disclosures required by ASC 842.

Per Example 6 of the codification, we have populated them in a separate tabular format as below.

By preparing the above disclosures, we have complied with the disclosure requirements of ASC 842-20-50-4-(f) through 842-20-50-4-(g).

And with this, we are all done with the quantitative disclosure requirements of Para 20-50-4.

Lastly, lessees are also required to prepare a Lease Maturity Analysis by the requirements of ASC 842-20-50-6. This analysis is meant to break down the future lease cash outflows for 5 years and beyond along with a reconciliation of the undiscounted cash flows to the lease liability appearing on the balance sheet.

Note that we have prepared a separate analysis for the operating and the finance lease as the codification specifically requires it.

Example 2: Qualitative Disclosures

For the qualitative disclosures to be given by a lessee, let’s refer to the Consolidated financial statements for the year ended 2022 of Nordstrom, Inc. to see how qualitative disclosures under ASC 842 are practically prepared.

- Information about the nature of its leases, including:

- A general description of those leases.

We lease the land, buildings, or land and buildings for many of our stores, office facilities, and Supply Chain Network facilities, as well as equipment. The following table summarizes the majority of our fixed, non-cancellable lease terms:

| Property Type | Lease Term (in Years) |

|---|---|

| Nordstrom Stores | 15 – 30 |

| Nordstrom Rack Stores | Approx. 10 |

| Office & Supply Chain Network Facilities | 5 – 20 |

2. The basis and terms and conditions on which variable lease payments are determined.

Most of our leases also require us to pay certain expenses, such as common area maintenance charges, real estate taxes, and other executory costs, the fixed portion of which is included in Operating Lease Costs. We recognize Operating Lease Cost, which is primarily included in occupancy costs, on a straight-line basis over the lease term. Variable lease cost includes payments for variable common area maintenance charges and additional payments based on a percentage of sales, which are recognized when probable.

3. The existence and terms and conditions of options to extend or terminate the lease. A lessee should provide narrative disclosure about the options that are recognized as part of its right-of-use assets and lease liabilities and those that are not.

Many of our leases include options that allow us to extend the lease term beyond the initial commitment period. At the commencement of a lease, we generally include only the initial lease term as we have determined that options to extend are not reasonably certain to occur. The exercise of lease renewal options is generally at our sole discretion. At the renewal of an expiring lease, we reassess our options in the agreement and include all reasonably certain extensions in the measurement of our lease term.

4. The existence and terms and conditions of residual value guarantees provided by the lessee.

Our lease agreements do not contain any material residual value guarantees or material restrictive covenants.

5. The restrictions or covenants imposed by leases, for example, those relating to dividends or incurring additional financial obligations.

Our lease agreements do not contain any material residual value guarantees or material restrictive covenants.

a. A lessee should identify the information relating to subleases included in the disclosures provided in (1) through (5), as applicable.

b. Information about leases that have not yet commenced but that create significant rights and obligations for the lessee, including the nature of any involvement with the construction or design of the underlying asset.

Net lease payments exclude $101 of lease payments for operating leases that were signed but not yet commenced as of January 28, 2023.

c. Information about significant assumptions and judgments made in applying the requirements of this Topic, which may include the following:

- The determination of whether a contract contains a lease

- The allocation of the consideration in a contract between lease and non-lease components

- The determination of the discount rate for the lease

N/A

Conclusion

We have discussed all the disclosures that you’d have to prepare as a lessee under ASC 842.

Very clearly, the list of disclosures to be prepared is long enough and is not explicitly achievable. The job gets even more difficult if you have to extract the numbers for each disclosure yourself. A better alternative to this is Cradle - just enter the lease details and the rest is done by the software including all the disclosures discussed above.