Should I comply with the lease accounting standard manually or with lease accounting software?

by Lucas Russell | 2021-06-24

The financial reporting requirements of the new lease accounting standards IFRS 16, ASC 842, and GASB 87 are no walk in the park. Is lease accounting software the solution?

The challenge: Compliance with ASC 842, GASB 87 & IFRS 16

You could argue the changes to the new lease accounting standards IFRS 16, ASC 842 and GASB 87 are the most significant accounting change since the implementation of accrual accounting. That might be a bit of an exaggeration but there hasn't been such a significant, far-reaching regulatory change to one individual accounting standard that will impact so many companies worldwide. Both the IASB and FASB have made it a priority to target off-balance sheet transactions. This new lease accounting standard ensures all lease accounting transactions in the scope of the applicable standard end up on the balance sheet.

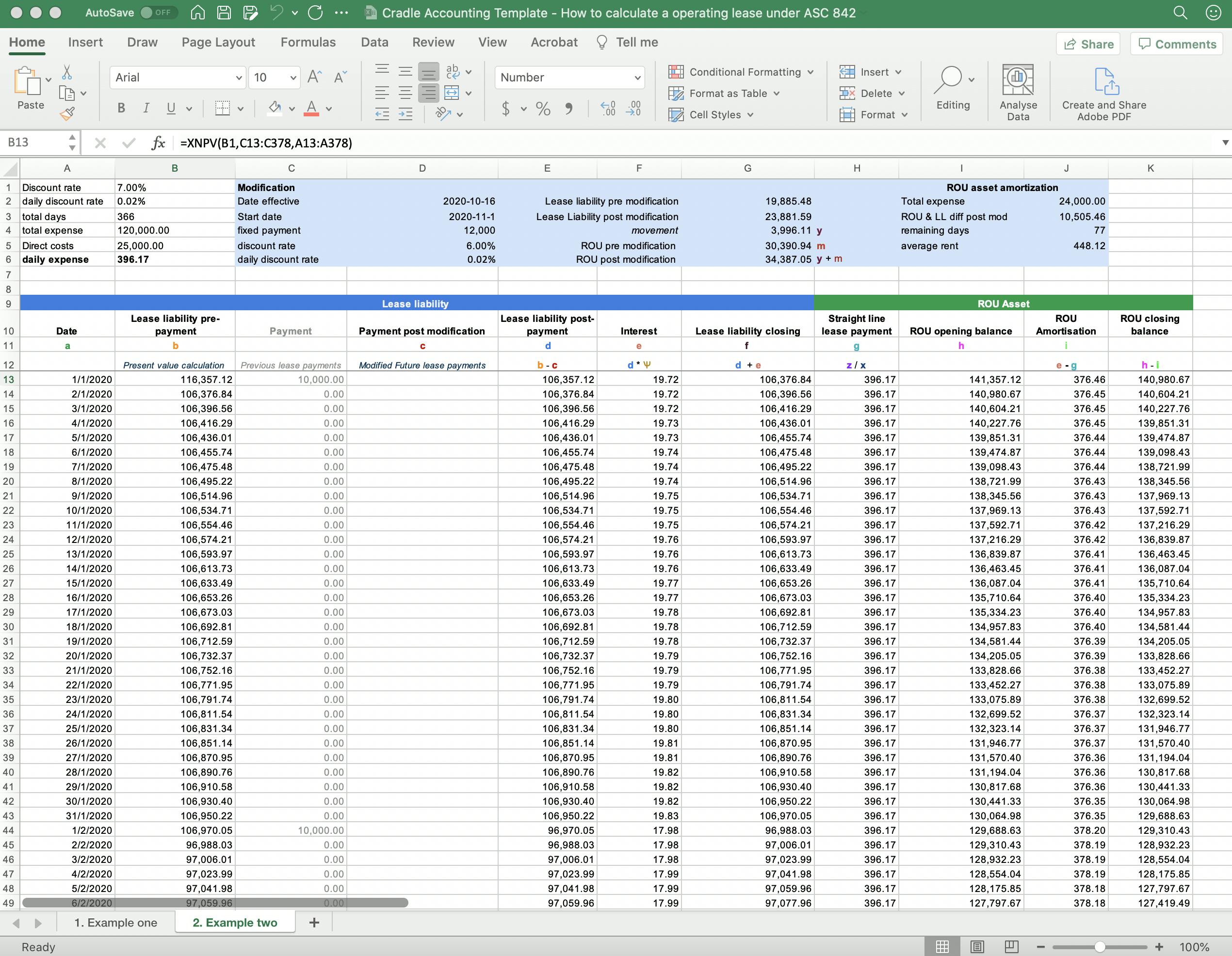

Under the new lease accounting standards, all operating leases must be recorded on the balance sheet, similar to a finance lease under IAS 17 and a capital lease ASC 840 by a lessee. Anyone familiar with accounting with those two previous lease classifications will realize this requires present value calculations which are a timely exercise.

That's because these calculations are based on the future cash flows at a point in time. The present value of these payments is now referred to as the lease liability. If those cash flows change, e.g., a fixed payment increase from the lessor, the cash flows need to be updated. This is only the tip of the iceberg to modification accounting. To do it correctly requires an intimate knowledge of the standard.

So far, we've only mentioned the lease liability. At the same time, the lessee needs to account for a right of use asset in conjunction being the debit entry at initial recognition of the lease. To reiterate this is for every lease. Most lease modifications, which are changes to contractual terms, will impact the value of both the lease liability and right of use asset.

Some companies may be acutely aware of these nuances if they've had to account for a lease manually. The requirements of the standard are not relaxed for disclosures, such as having to split the lease payments between principal and interest.

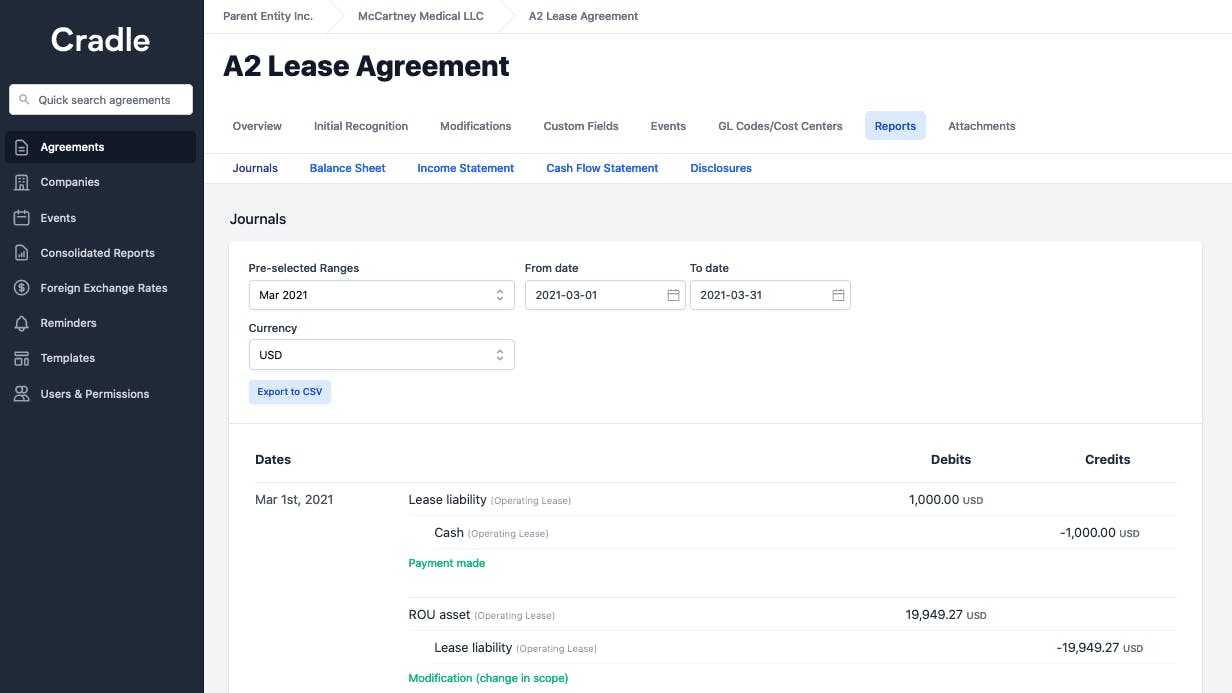

Given these complexities and many more, lease accounting software is available that will automate all of the required calculations, journal entries, financial reports, and disclosures. This provides an alternative to maintaining at the very least two Microsoft excel calculations of the right of use asset and lease liability if a company has one lease.

If you are unclear regarding the requirements of the new lease accounting standards, the following articles provide some further information:

- History of Lease Accounting

- How to Calculate the Present Value of Future Lease Payments

- ASC 842 Summary

In this article, we'll explore the positives and negatives of adhering to the new lease accounting standards IFRS 16, GASB 87, and ASC 842 either manually or using lease accounting software. The particular lease accounting standard a company needs to adhere to depends on your financial reporting requirements.

The solution: Lease accounting software or manually in excel

If compliance is mandatory, a company has two options when adhering to the new lease accounting standard. For many, the most familiar option will be to perform the required calculations manually in excel. As any accountant can attest to, a lot of accounting is done in excel. This would be no different.

The alternative is lease accounting software. This is a new concept. First of all, the software will perform the present value calculations. Secondly, the software will be able to generate the journal entries and all the financial reports. So what's the best option?

Manual lease accounting compliance

The positives of complying with the lease accounting standard manually are:

- Immediate start: It's safe to say your organization will have a subscription to Microsoft excel, and even if you didn't have that, Google Sheets is a free alternative. What's also great is you do not have to go through the buying process. This can not be underestimated, as if you're going to procure buying something embedded in your financial reporting processes for years to come, you want to ensure you select the right solution. By doing it manually in excel, you remove all the demos you'll have to view, any NDA's that need to be signed, and negotiation and commitment to a contract.

- Available resources: I think anyone can quickly justify the new lease accounting standard requires more work to comply with than its predecessors. But that may not come as a burden if you have available resources who have the skills and expertise to hit the ground running. This quickly becomes a negative if you have to employ additional resources to handle the requirements of the lease accounting standard. If that's the case, the software will work out cheaper.

- Small lease portfolios: The more leases an entity has, the more cumbersome it becomes to comply with the standard. One or two leases are manageable in excel if you don't mind pulling up your sleeves.

- Ownership: Ultimately, you're entirely in control of your compliance. Yes, excel can crash, hard drives can get wiped, but you're reducing the load on a third party by complying manually. Let's be frank; if your lease accounting software is down/not available and quarterly/half-year or annual reporting comes around, it's not going to be pretty.

- No additional costs: If there are current staff members with capacity and a solid understanding of accounting principles this could be addressed by a current resource resulting in no additional costs for compliance

So what are the negatives if a company were to opt with calculating the lease liability and right of use asset manually:

- Time: The two main areas which will be the most time-consuming aspects of manual compliance are:

- Doing the calculations: When doing it manually, there's no way you can get around the present value calculations. Each lease requires a calculation of the right of use asset and a lease liability. When the contractual terms are changed that impact the calculations, these calculations need to reflect these changes. This is equivalent to doing the calculations again from scratch.

- Understanding the standard: Before doing the calculations, an intimate knowledge of IFRS 16, GASB 87, or ASC 842 or some cases, both standards are required. - Manual error: Complex present value calculations performed in excel are susceptible to manual error. For an already busy finance team, the likelihood of error increases.

- Visibility: Not having a centralized platform to store the lease documents and the applicable lease liability and right of use asset calculations does increase the risk of "completeness" of the lease accounting.

- Reporting: Having to translate the manual calculations to debits and credits and, ultimately, financial statements is time-consuming. Alternatively, you can run your journals, financial reports, and disclosures with software for any period at a click.

- Security: It's unlikely that the excel file will be password protected, nor back-ups of those files stored. In addition, many accountants can attest to how many times excel has crashed, and they've lost a morning's work.

For anyone opting to calculate a lease manually, you mind find these following articles helpful:

Lease accounting software

The positives of complying with the new lease accounting standards IFRS 16, GASB 87, and ASC 842 with the use of lease accounting software are:

- Accuracy: The risk of inputting incorrect formulas, and all the other things that can go wrong is entirely mitigated by using lease accounting software. With the aid of lease accounting software, input a lease a thousand times and get the same result, to the decimal place.

- Time: Regardless of performing the calculations manually or with software, someone must extract the lease data—for example, the commencement date of the lease and the discount rate to be applied. Once input into lease accounting software, that's it, lease accounting done. On the other hand, when doing the calculation manually, the work has just begun.

- Removal of repetitive tasks: Lease accounting software removes all the necessary repetitive manual tasks. A clear example is determining the monthly journals of the right of use asset and a lease liability. Instead, the accounting team can focus on other tasks.

- Standardization: Applicable for companies that have more than one staff member performing the lease accounting calculations. Having a standardized method means uniform financial reporting across all offices.

- Visibility: Lease accounting will allow any user to access key financial information at any time. If the CFO wants to look at the lease liability and right of use asset value on a specific day, they can. There's no need to go to the underlying calculations, input the journal entries and then finally look up the information in the company's accounting software. Furthermore, it's just not the finance team that may need access to lease information. As a result, all departments in the organization can access the information when they need it.

- Staff morale: A company's employees want to be stimulated and challenged. Lease accounting software removes those laborious manual tasks and frees up time to focus on more interesting areas of work.

Negatives

- Price: The most significant barrier to entry is the price of lease accounting software. Unless a company is acutely aware of the demands of IFRS 16, GASB 87 & ASC 842, they may have allocated zero budget to handle the new lease accounting standard's requirements. A company can also let the burden fall on the current employees, resulting in no impact on their bottom line.

- Usability: If the lease accounting software has all the required features but is not user-friendly, it severely detracts from the benefits of opting with the software.

- Software outages: Although uncommon, it is a risk.

- Software is incorrect: The numbers output from the software could be wrong. Before selecting a lease accounting software solution, it is essential to perform due diligence. Onboard your most complicated lease and ensure the software can handle the inputs.

The majority of the solutions in the market price per lease managed, meaning the more leases you have the higher the subscription costs. For more information to help determine what lease accounting software is most appropriate for your company's financial reporting requirements, refer to the following article Lease Accounting Software Selection Guide.

Lease accounting software Vs Manual lease accounting

If lease accounting software was free and easy to use, there's no reason why every company should not use it to perform their lease accounting. That's based on the assumption that it's accurate, reliable, and easy to use. The benefits of using lease accounting software far outweigh those compared to complying with either ASC 842, GASB 87, or IFRS 16 manually.

The biggest driver if a company should use lease accounting software will be its portfolio size. The greater the portfolio size, the more manual time it takes, So what's the number of leases to manage manually?

A simple return on investment can help calculate this. Let's say a senior accountant is the preparer of the calculations and the financial controller reviews, and the company reports internally each month. The company has one lease and will account for that lease manually:

| Time spent on manual compliance | |

|---|---|

| Task | Hours per annum |

| Understand the requirements of the standard | 7 |

| Prepare lease liability and right of use calculation | 7 |

| Month-end | 12 |

| Total | 26 |

The above total hour estimate does not factor in the following:

- modification accounting both understanding the requirements of the standard and updating the lease calculations

- Errors and the time to correct those in excel

- Interaction with auditors to provide lease information and calculations

Let's assume the staff cost is $100 per hour, which is a blend of the senior accountant and the financial controller's cost to the company. So to prepare one lease costs the company $2,600 in the first year and then $1,200 annually.

This is a quick back-of-the-envelope estimate, but it does give an indication of the time it costs the company when complying manually. By doing so provides a good indication of when lease accounting software is a worthwhile investment. In this example, if a company can procure lease accounting software for $1,200 or less a year to manage one lease it's a positive return on investment.

Conclusion

The analysis performed concludes the benefits of using lease software far outweigh adhering to the lease accounting standard manually. The most significant inhibiting factor is the cost of the software. Each company will reach a threshold where the cost for a company not using software will outweigh the subscription price of the software. This will likely vary from company to company. Using the example above, even just one lease a company could justify using accounting software.

Manage 10 leases in Cradle for $99 a month!

Compliance couldn't be easier, sign-up online now and get your lease accounting done. Don't believe us? Try our 30 day trial, no strings attached.