Microsoft Excel

Free Lease Accounting Calculator

Lucas Russell | 2021-03-01

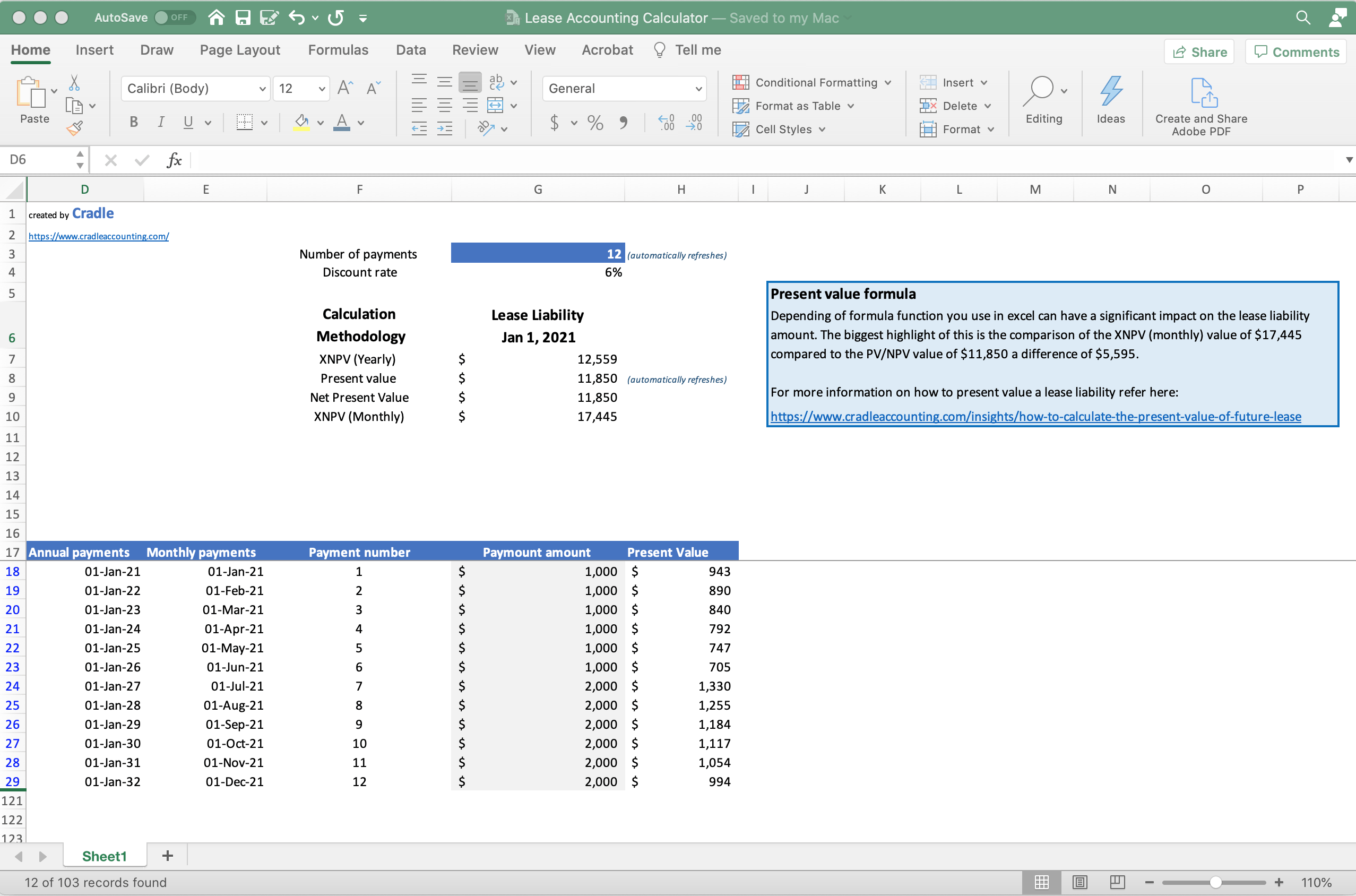

No matter if it’s a lease under ASC 842, IFRS 16, or GASB 87, how the lease liability is calculated at initial recognition is the one thing the new lease accounting standards have in common.

A lease liability is the known future payments at the commencement of the lease. If you’re transitioning to ASC 842, it’s the known payments at transition date if you adopt the effective date method (more about that here).

This calculator will calculate the lease liability amount once you input the three inputs into the calculation number of payments, payment amount, and discount rate. The lease liability calculator will also highlight the different ways you can calculate the lease liability.

Using this excel tool will help you:

- Calculate the present value of your leases

- Allow you to get an understanding of the impact a lease will have on the balance sheet

- Provide a comparison of different present value methodologies

If you would like this excel template please reach out to [email protected].

May your debits always equal your credits 😁