How to transition to ASC 842 with an operating lease

Lucas Russell 2021-09-06

Lessees with operating leases are the most impacted by the new lease accounting standard. There are two main hurdles when transitioning to the new lease accounting standard ASC 842, and they are:

- Understanding the new lease accounting requirements under ASC 842 and how they differ from ASC 840

- Figuring out how to transition to ASC 842 and the options available to make the transition to ASC 842 as simple as possible

The purpose of this article is to go step by step of how a lessee with an operating lease will transition to ASC 842.

Changes under ASC 842 when accounting for an operating lease

To understand the changes, we first need to start at the accounting requirements for an operating lease under ASC 840.

How to account for an operating lease under ASC 840

The accounting treatment for an operating lease under ASC 840, which is very straightforward, recognize an expense on a systematic basis:

ASC ASC 840-20-25-1

Rent shall be charged to expense by lessees (reported as income by lessors) over the lease term as it becomes payable. If rental payments are not made on a straight-line basis, rental expense nevertheless shall be recognized on a straight-line basis unless another systematical and rational basis is more representative of the time pattern in which use benefit is derived from the leased property, in which case that basis shall be used.

In other words, the lessee would expense the lease payments, and accounting for the lease results in no balance sheet impact (other than the eventual reduction of cash when the invoice is paid, like with any payment). However, under ASC 842, accounting for an operating lease is far more complex, and there are several accounting judgments the lessee must make.

Hint!

You may ask, doesn't the lease definition and classification test change under ASC 842? It does, but the lessee has the option to apply a package of practical expedients under ASC 842-10-65-1. With these practical expedients, a lessee with an operating lease does not have to:

> Reassess if the lease is in the scope of ASC 842 and meets the definition of a lease under ASC 842.

> Reassess the classification of the lease and;

> Reassess initial direct costs incurred are in the scope of ASC 842.

A lessee cannot pick and choose and must apply all the practical expedients to their lease portfolio. But, for ease of transition with an operating lease to ASC 842, I'd highly recommend utilizing that practical expedient offered by the standard setters.

How to account for an operating lease under ASC 842

The most common type of lease is an operating lease. Most companies have at least one. The accounting for an operating lease completely changes under ASC 842. The combination of these two inputs is why the new lease accounting standard has generated so much attention.

So what are these changes?

A right-of-use asset and lease liability will be recognized on the balance sheet for all operating leases. The lease liability is the present value of the known future lease payments at a point in time.

There are three inputs into calculating the lease liability value:

- Lease payments

- Lease term

- Discount rate

The right of use asset value is derived from the lease liability value, plus a few additional inputs. The lease liability and right of use asset are then amortized over the lease term. Thus, upon the expiry of the lease, both values are zero. Later on, we'll get into the nuances of these calculations.

Transition date

This might go without saying; you cannot pick and choose the transition date on an individual lease basis. Instead, the transition date is applied on a company-wide basis.

Transition method

Before going any further, we’ll discuss the transition methods available when transitioning to ASC 842 with an operating lease. This is important because it will directly impact the calculation of the lease liability and right of use asset and, in turn, a company’s financial statements.

There are two methods available, the effective date method and the comparative method. If your objective when transitioning is to take the most straightforward and time-efficient way, the effective date method unequivocally is the method to select. For calculations later on in the post, we will exclusively focus on the effective date transition method. Like the transition date, the transition method must be applied on a company-wide basis.

Effective date method

The effective date method allows a lessee to apply the new lease accounting standard on a prospective basis. What this means is when transitioning the operating leases to ASC 842, you will pick up the lease obligation as of the transition date.

By adopting this method is means:

- There is no need for historical lease information. Instead, ASC 842 is applied using the current lease details of the operating lease prospectively.

- There is no need to adjust prior year financial statements.

The standard-setters initially did not offer this transition method. However, due to the complexity and time involved in applying the standard retrospectively, they made this concession using the effective date method.

The drawback of applying the effective date method is that in a set of financial statements, the comparative balances are accounted for under ASC 840. As a result, there's no ability to compare and contrast the movement of lease accounting balances. If the standards setters permit companies not to have consistent comparative information, this will not be an issue for most companies. Nonetheless, when deciding if the effective method is appropriate for a company, there should be a consideration on how this method will impact the users of the financial statements.

Comparative method

This method is where you retrospectively apply the new lease accounting standard ASC 842 to the earliest comparative balance within a set of financial statements. This means you will require historical lease information and apply lease accounting standard principles like modification accounting straight off the bat. By adopting this transition methodology, a company will need to restate its comparative periods in a set of financial statements. In other words, the restatement of the prior year balances, which would now include the lease liability and right of use asset on the balance sheet.

However, it’s the more time-consuming option of the two standards and will provide the most detailed information.

How to calculate the lease liability and ROU asset transition balances under ASC 842

The assumption moving forward is that we will apply the effective date method when calculating the lease liability and right of use asset for an operating lease.

For those who want to transition using the comparative method, I'd recommend reading this article that takes you step by step on calculating a lease from commencement.

When transiting to ASC 842, there are several additional one-off inputs to consider. The reason for this is that from the lessee's perspective, it's not a new lease, and certain balances might need to be carried over.

How to calculate the lease liability at transition

When calculating the lease liability transition balance for an operating lease under ASC 842 using the effective date method, it’s incredibly similar to calculating the lease liability at the commencement of the lease. The key difference is you’re applying ASC 842 to the lease agreement from the transition date. Noting this point, we will go through each input of the lease liability.

Lease payments

When determining the lease payments for an operating lease transitioning to ASC 842 using the effective date, it’s based on future payments at the transition date. All payments made before the transition date are ignored. That’s because the calculation of the lease liability is the future known lease payments at a point in time. In this case, the point in time is from the transition date. The principles of determining the lease payments that are used to calculate the lease liability do not change.

Here’s an example to help illustrate this point:

Ringo Inc is a private company that will be transition to ASC 842 on January 1, 2022. Ringo to save time and try and make the transition to ASC 842 as smooth as possible is applying the effective date method available when adopting ASC 842. Ringo’s lease portfolio entirely consists of one operating lease that commenced in 2015 and will expire in 2025. There has been no changes to lease payments since inception which have been $2,000 a month, Ringo will continue to pay that amount until expiry of the lease.

What lease payments should Ringo include in the calculator of the operating lease lease liability?

1. All lease payments from commencement

2. The lease payments from January 1, 2022

The answer is b. In this example because Ringo is applying the effective date method, Ringo would only include the lease payments from January 1 2022 when calculating the lease liability at transition.

What are the total un-discounted lease payments?

$72,000 ($2,000*12*3)

Workings

> Lease payments are $2,000 per month

> 12 lease payments per year

> 3 years remaining of the lease term at transition

Like with determining the lease payments, the principles applied when determining the lease term does not change when transitioning to ASC 842. The only difference is you’re using those principles from transition to ASC 842 rather than the commencement of the lease.

Discount rate

As with the previous inputs, the discount rate is determined at the transition date, using the information available at that date.

Hint!

For any non-public company, there is a practical expedient ASC 842-20-30-3 – which allows a lessee to use a risk-free rate for a period comparable to the lease term. This has to be applied as an accounting policy election and applied to the entire lease portfolio. If this expedient is applied, it will result in a higher lease liability and right of use asset value.

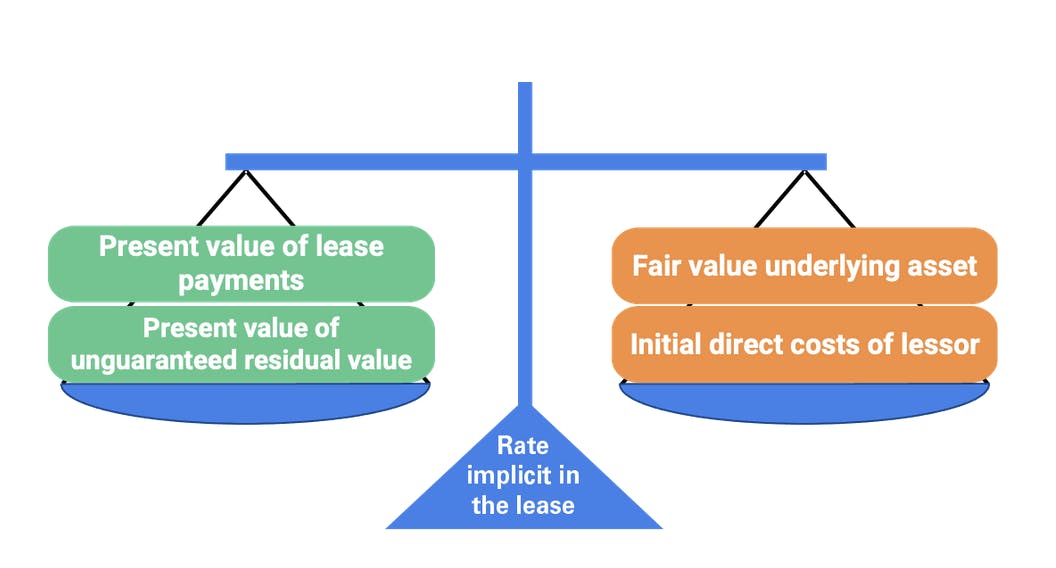

How to calculate the right of use asset at transition

To calculate the right of use asset, you first need to calculate the lease liability. In this case, it will be the lease liability value at transition. That is the cornerstone of the value of the right of use asset. Once that value has been determined, there are some further considerations to make, which the below diagram summarizes:

We’ll now go through each input. As you can see, several inputs only apply to an operating lease at transition using the effective date method.

- Unamortized direct costs: If the package of practical expedients is applied, the lessee does not need to reassess the unamortized direct costs. This value will be added to the right of use asset. If the package of practical expedients is not applied, the lessee will not need to assess if the direct costs previously recognized under ASC 840 meet the definition under ASC 842.

- Unamortized incentives: Any lease incentives before commencement would be deducted from the right of use asset value.

- Prepaid rent: Any prepaid rent before the transition to ASC 842 will be added to the value of the right of use asset. The lessee would derecognize the prepaid asset, adding that amount to the right of use asset value.

- Accrued rent: Any rent owed at the transition date will be subtracted from the right of use asset.

- Carry amount of any liability under ASC 420: Entities accrue for the remaining costs to be incurred under the lease and, if applicable, the cost of terminating the lease contract. Therefore, to the extent that such balances were recognized, the balances should reduce the ROU asset balance as of transition. This balance should be recognized against the ROU asset at initial recognition.

- Impairment: If impairment is applicable, the amount to be recognized is deducted from the right of use asset.

Practical Example

Jagger Inc. enters into a four-year lease on January 1, 2019, with annual lease payments payable at the start of each year. Jagger Inc. will transition to ASC 842 is January 1, 2022, using the effective date method.

The lessee accounts for the lease as an operating lease. At lease commencement Jagger Inc. defers initial direct costs of $500.

On January 1, 2022, Jagger Inc. has:

- An accrued rent liability of $10,000 for the lease, reflecting rent that was previously recognized as an expense but was not yet paid as of that date

- Unamortized initial direct costs of $400 remain

- Pays $5,000 per month to use the leased asset

- A incremental borrowing rate is 6 percent.

Jagger Inc. has elected the package of practical expedients in paragraph 842-10-65- 1(f). As such, the lessee accounts for the lease as an operating lease without reassessing whether the contract contains a lease or whether the classification of the lease would be different under ASC 842.

Jagger Inco also does not reassess whether the unamortized initial direct costs on January 1, 2022, would have met the definition of initial direct costs at lease commencement.

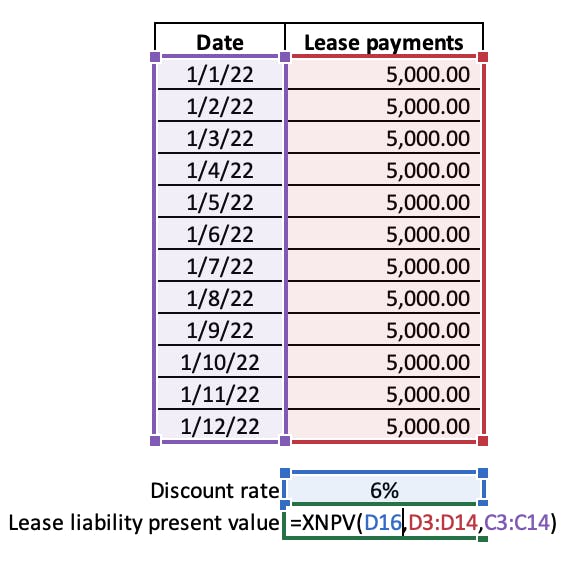

Q 1) What is the lease liability amount for Jagger Inc. at transition?

The lease comes on the balance sheet with three years remaining. The future payments at January 2021 are as follows:

Using the XNPV function within excel with a discount rate of 6% would result in a lease liability amount of $58,434.41.

We recommend using the XNPV function as that’s the most accurate present value calculation methodology. For more information on how to calculate the present value of lease liability, refer here.

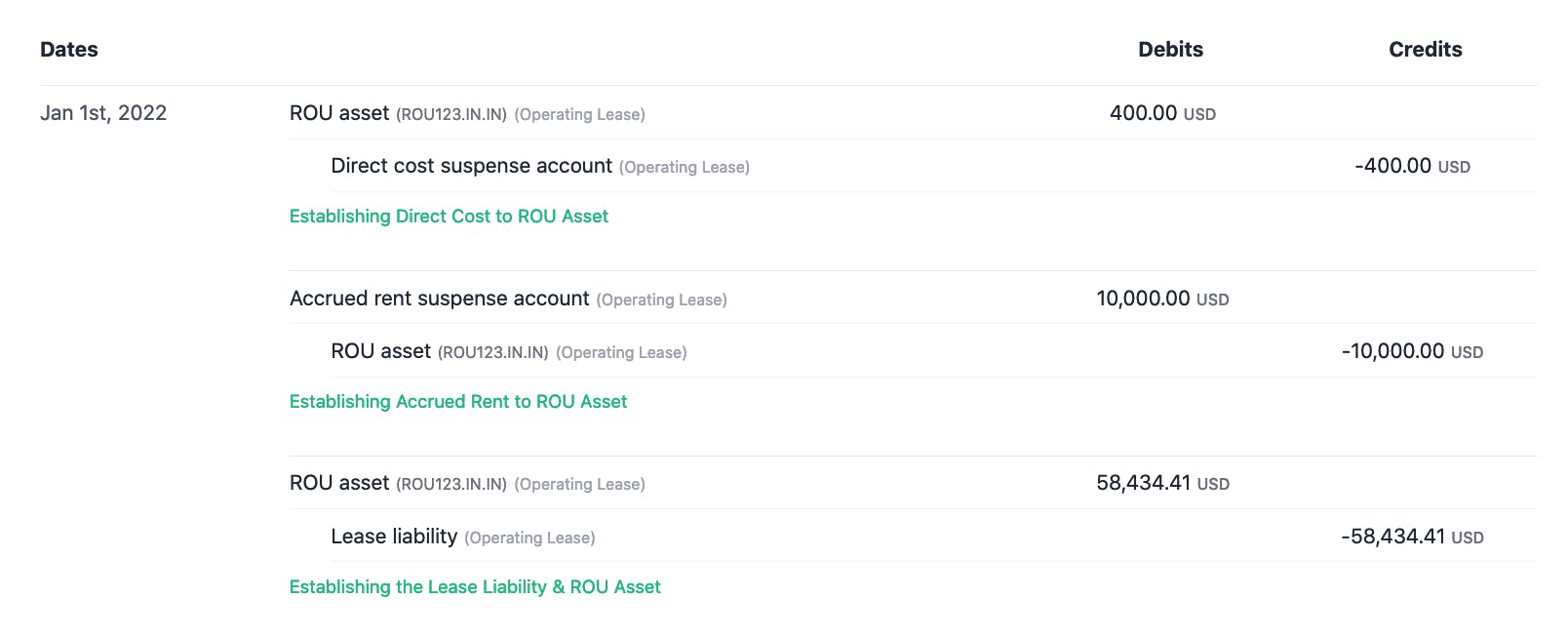

Q 2) What is the right of use asset value at transition:

ROU asset amount = $58,434.41 (lease liability value) - $10,000 (accrued rent) + $400 (direct costs)

ROU asset: $48,834.41

Given the entity has applied practical expedient ASC 842-10-65-1, the unamortized direct can be added to the right of use asset.

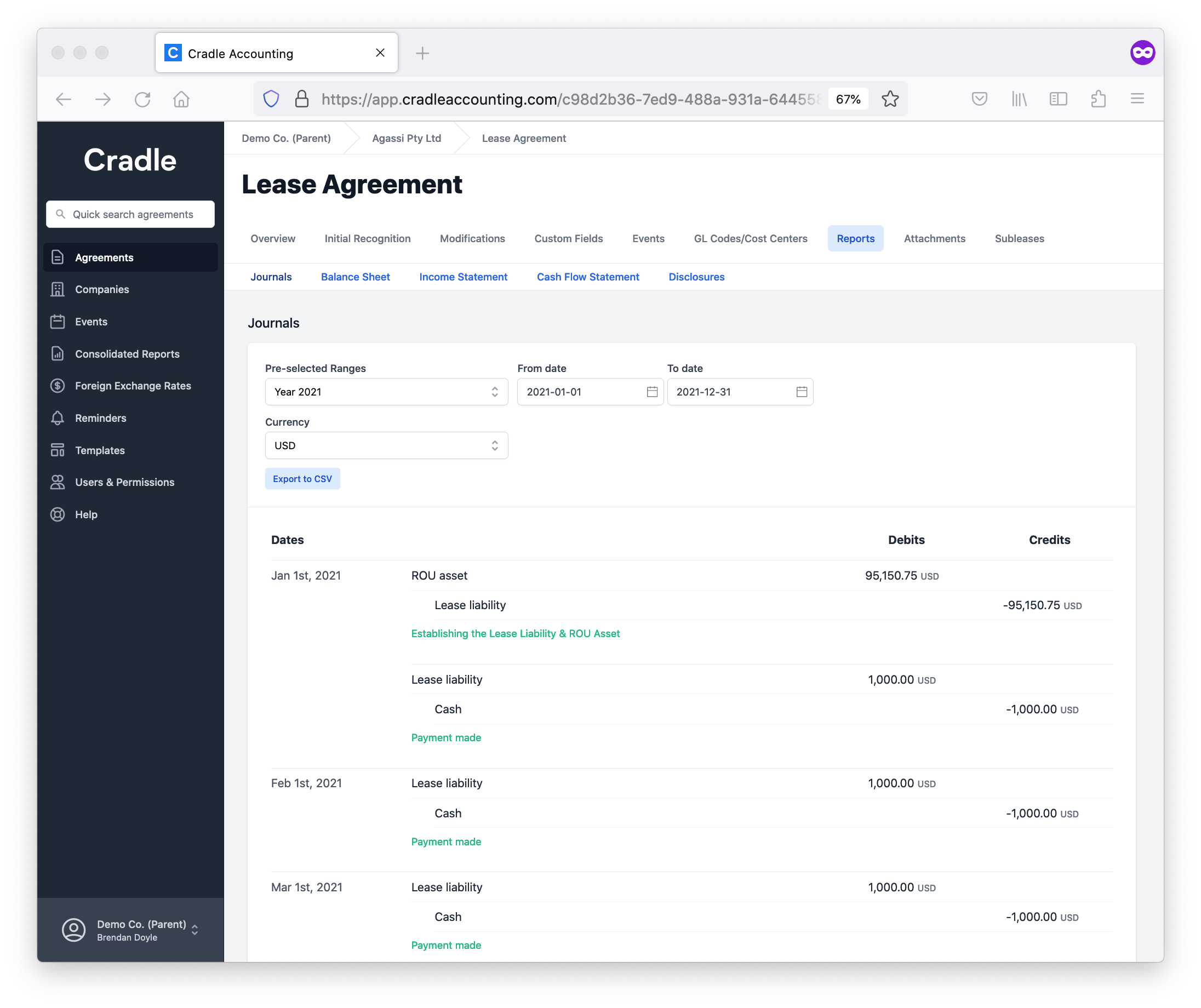

Q 3) What are the journal entries incurred at transition:

Conclusion

The transition to ASC 842, like any transition to a new accounting standard, is a significant amount of time. First, you must understand the requirements of the new lease accounting standard. Second, it’s putting theory into practice. You will need to calculate the present value of the lease and record the appropriate journal entries. If you want to save time, using lease accounting software can save a significant amount of time and increase your financial reporting accuracy.

Let Cradle handle your transition to ASC 842

Why not let the transition to ASC 842 be an opportunity to improve your financial reporting processes? Compliance with ASC 842 is mandatory but spending time on it isn't.